by Aneesha Chitgupi, Karthik Suresh and Diya Uday.

Introduction

What is a startup? The academic literature takes a broad view --- startups:

- have a high growth rate (Moogk 2012),

- have a lower number of employees (Beck et al. 2008),

- are at the early stage of the life cycle of a firm (Eisenmann 2013, Stevenson and Jarillo 1990), and

- are drivers of innovation (Cohen and Klepper, 1996).

However, governments across the world focus on the link between startups and innovation. In the Netherlands, a startup is defined as "a business that translates an innovative idea into a scalable and generic product or service, using new technology." In the United States, a startup is one that "has never been an SEC reporting company, uses invested capital, often from venture capital investors, to build an innovative growth focused, scalable business." The Israeli "innovation model" is "largely based on the creation of technological value, mainly in start-up companies and multinational corporations R&D centres".

This is true of the Indian government as well. The stated objective of the Startup India Action Plan of 2016 is to promote innovation. The idea that startups are innovative is also reflected in the draft Science, Technology and Innovation Policy of 2020) as well as foreign policy initiatives like the Engagement Group on startups at the ongoing G-20 Summit.

The Startup India Policy offers a suite of regulatory exemptions and incentives linked to innovation by startups. Two key components of this policy are: (i) reduced fees and priority in processing patent and design applications for startups, and (ii) full exemptions on income tax to the startup following approval from an Inter-ministerial Board (IMB). The Startup India Policy has been amended several times. Key changes relating to the definition of a startup have been:

- February 2016: a startup is (i) not older than five years from the date of its incorporation/registration, (ii) turnover in any of the previous five financial years has not exceeded INR 250 million, and (iii) it is working towards innovation, development, deployment or commercialisation of new products, processes or services driven by technology or intellectual property. The startup should develop and commercialise "a new or a significantly improved product or service or process that will create or add value for customers or workflow".

To be registered with the DPIIT, as well as to qualify for the tax exemption, a startup needs to be recommended by a registered incubator, or an angel/private equity/ accelerator fund with at least 20 per cent funding, or by the Union or state government as part of a scheme to promote innovation, or it should have filed a patent. - May 2017: the age of an eligible firm and the period for calculation of turnover was increased from five to seven years from the date of its incorporation/registration (ten for firms in the biotechnology sector).

In addition to the definition, a startup may now also have scalable business models with a high potential of employment generation or wealth creation to gain benefits.

To register as a startup and avail of the tax exemption from the IMB, a firm now only has to make an online application by providing the details of (i) certificate of incorporation/ registration and "other relevant details as may be sought", and (ii) a write-up about the nature of business highlighting how it meets the criteria in the definition. The DPIIT would consider "innovativeness" from a domestic standpoint. DPIIT may grant or reject recognition after review. - February 2019: age requirement of an eligible startup was relaxed to ten years for firms across all sectors. The turnover limit was increased to INR 1 billion.

Given the emphasis on "innovation", we consider it important to examine whether India's policies are incentivising innovation by startups by asking the following questions:

- Are startups in India engaging in innovation?

- How innovative are Indian startups compared to non-startup firms?

To answer this, we require some well-accepted measure for studying startup innovation. We adopt the most popular method i.e. using patent fillings and grants as proxies to measure innovation (Wang 2018; de Rassenfosse 2019; Katila 2000). We chose this over other proxies like expenditure on R&D (Rothwell and Ziegler, 1981; Geroski, 1989). We examine our questions using patent filings and grants to startups. We also use a novel measure i.e. the benchmarks for innovation as defined under the Startup India policy. We found that startups are not driving "innovation" in the conventional sense of the term in India.

We lend new insights into the conventional wisdom on startups and innovation in India and highlight the need for a re-look at the current policy on startups in India.

Methodology

We use two methods to determine whether startups are engaging in innovation:

(i) Measuring innovation using patent applications and grants: We hand-collected data on patent filings and grants from the Indian Patent Office across different categories of entities for the years 2016-17 to 2020-21. We substantiate this data using the annual reports of the Department of Promotion of Industry and Internal Trade (DPIIT). We examined the fraction of patents filed and granted by startups over the years compared to other entities.

(ii) Measuring innovation using startup registration and granted Income Tax (IT) exemptions under the Startup India Policy: The Startup India Policy 2015 requires startups to be innovative to (i) register as a startup and (ii) be granted IT exemptions under the Startup India Policy read with section 80-IAC of the Income Tax Act. We collected data on the number of startups that have successfully received tax benefits (after being classified as innovative). We then calculated the fraction of startups that were granted exemptions versus total startup registrations. For this, we collected data on startup registrations, applications for IT exemptions and approvals to applications of IT applications for all states and UTs in India between 2016-2022. We aim to gain insights into how many startups are "innovative" according to the policy definitions of "innovation".

We also collect currently available data on the total number of startups in India with the number of startups that are registered with the DPIIT. However, this is only available for the current year. We aim to examine how many startups in India qualify under the policy definition of a recognised startup to examine the stringency of the definition of a startup.

We conducted a detailed analysis of startup policies in India to give us further insight into our results from (i) and (ii) above.

Results

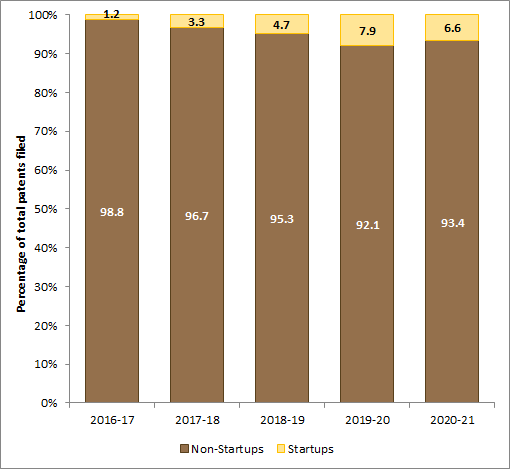

Impressive growth rate in patent filings by startups but their overall share remains small: We examined patents filed and granted by Indian startups versus other Indian entities which include small firms, private and public firms, and natural persons. We did not include foreign firms and institutions filing for patents in India or Indian entities filing for patents abroad. We found, across the years, that the number of patents filed by startups has increased possibly on account of the fee waiver and fast-tracking of applications. We also see specific increases in the years in which these interventions were made (May 2017, February 2019) when patent filings doubled (see Figure 1). The CAGR for patents filed by startups and other entities show a disproportionate growth rate for startups at 54 per cent for the period between 2016-17 to 2020-21 which was nearly 12 per cent for other entities for the same period. We found that startups constitute a small proportion of the total patents filed in India when compared to other entities. Patent filings were largely driven by large firms and universities.

Figure 1: Fraction of patents filed by startups over non-startups (2016-17 to 2020-21)

Disproportionately fewer startups were granted patents: The share of patents granted to startups peaked at 8.8 per cent during 2017-18, remained the same the following year and has declined since then. One reason for this could be that startups were obliged to file for a patent to receive registration under DPIIT as well as for applying for IT exemption. The reason for the drop in shares of both patents filed and granted during 2020-21 could be the removal of patents as a condition for registration of a startup and for IT exemption (in May 2017). We also believe that there could be an overall decline in the quality of patents filed. It appears that while the current policy has incentivised firms to file patents, their applications do not pass the more stringent test of proving innovation and hence they fail. The threshold required to grant a patent is strict and requires a firm to prove novelty, which is not the case at the application stage where anyone may file for a patent.

Figure 2: Fraction of patents granted to startups over non-startups (2016-17 to 2020-21)

Source: Annual reports of Indian Patents Office

Figure 1 showed that the share of patents filed by startups in total patents filed was rising during the period 2016-17 to 2019-20. This is not the case for the share of patents granted (Figure 2).

Less than two-fifths of startups registered with DPIIT qualify for benefits: We find that since 2016, the number of companies registered as startups under the Startup India Policy with the DPIIT has increased in absolute terms. However, the growth rate over time has reduced. We further find that out of all the startups that exist in India, only a percentage of them qualify as "startups" under the Startup India Policy and have been registered as such. For instance, there are 2,49,107 startups in India (as on February 2023) out of which only 90,939 (36.5 per cent) are registered by the DPIIT as startups. It is possible that the unregistered startups have either not applied to be registered or have not qualified as startups as per the definitions. This raises the question: is our current definition of a startup under the Startup India Policy the right one? Should we rethink the definition to extend the benefits of the policy to more startups on the ground?

Low grant percentage of IT exemptions for startups: We found that out of the total number of registered startups, less than 2 per cent of startups have been granted the IT exemption, signifying that few startups have been certified as innovative as described in the Startup Policy on external scrutiny by the IMB. We validated this with data on the number of applications for the IT exemption for the year in which this data is available (2017) and found that 90 per cent of registered startups applied for the IT exemption in that year. This indicates that the low fraction of startups receiving IT exemptions is not for the lack of application on the part of registered startups. This has even prompted questions in Parliament.

To be registered as a startup under DPIIT, a startup has to only declare that they are working towards innovation, whereas to obtain an IT exemption, the fact of innovation is scrutinised by the IMB based on specific criteria because of which a startup may not qualify. It is possible that, at registration under the policy a startup need not demonstrate innovation but only declare it, however, for the IT exemption it must now demonstrate and prove innovation in the manner specified in the policy. It appears that few startups are actually being innovative according to the Startup India Policy. Table 1 summarises our findings.

Table 1: Total startups registered and granted IT exemptions based on whether they are "innovative" (2015-2016 to 2020-21).

| Year | Number of startups registered | Growth rate (%) | No of startups granted 80-IAC | Fraction of total (%) |

|---|---|---|---|---|

| 2015-16 | 471 | -- | 7 | 1.5 |

| 2016-17 | 5233 | 1011 | 69 | 1.3 |

| 2017-18 | 8775 | 68 | 18 | 0.2 |

| 2018-19 | 11417 | 30 | 162 | 1.4 |

| 2019-20 | 14596 | 28 | 83 | 0.6 |

| 2020-21 | 20160 | 38 | 70 | 0.3 |

Source: Authors' calculations from DPIIT data

Limitations: (i) We do not have access to consistent yearly data on the number of total startups v. those which are registered. (ii) We do not have data on the pre-policy period. (iii) Our present study is not focused on industry-level features. We intend to pursue this in the next leg of our study.

Discussion

Our findings indicate that both measures --- IT exemption grants based on innovation and patents filings and grants --- suggest that innovation in India does not consistently emerge from startups. Instead, our findings are in line with studies in other jurisdictions which suggest that large firms undertake most innovation on account of their risk appetite and R&D capacity (Cohen and Klepper 1996, Symeonidis 1996). Our findings are also aligned with reports that indicate large firms and universities engage most in innovation if measured by patent filings in India. Is this, however, a true picture of innovation on-ground? And what are the implications of our findings for current innovation policies for startups?

The literature makes the case for government intervention on startup innovation citing the disparity in the ability to compete as a market failure (Wang 2018, Symeonidis 1996). The argument is that startups require a boost to even out the playing field as they are unable to compete with larger firms with more resources. Our findings lend some support to this by demonstrating that (i) startups in India are not innovating as much as large firms, and (ii) patent filings by startups have increased since the Startup India policy came into effect. We also, find that patent grants to startups have not increased. Therefore, despite government intervention in India, startups are not driving innovation. Some explanations for this are as follows:

- The current set of incentives may not be sufficient to drive startups to innovate more. We find some support for this in the literature that finds that supply-side policies alone (e.g. subsidies) are not sufficient to stimulate innovation (Geroski 1989). Focusing on additional demand-side measures such as public procurement of innovation from startups may trigger greater innovation as it reduces the market risk for innovators (Rothwell et al. 1981; Tiwari 2017).

- Conventional notions of innovation are linked to "novelty" through patenting which is a very high standard for measuring innovation. In reality, startups in India may be engaging in innovation which is not eligible for conventional patents such as technological improvements or modifications suited to the domestic context. Reports suggest that startups in India adopt rather than innovate in the conventional sense. For instance, India is using the technology adoption route for developing Web3.

Another reason could be that Indian firms are innovating but are not registering patents in India. Reasons for this range from poor enforcement in India to sector-specific commercial preferences. An example of the latter is the semiconductor sector --- India has a large chip design industry but this work is done on a contract basis for US semiconductor firms which file their patents in the US.

Therefore, patents may not be the best way to measure innovation in India. Current startup policies in India should re-think the definition of "innovation" and make it more suited for the Indian context.

We gain some insights from the innovation-linked incentives that are offered by other countries. In South Korea, which has the highest per-capita granting of patents in the world, all startups irrespective of how innovative they are qualify for reduced fees in patent filings and certain tax exemptions available to SMEs. South Korean policy appears to focus more on promoting linkage between large and small firms to promote networking and market access. In the Netherlands, which ranks ninth in the world in patent filings, vouchers are given to SMEs for patent filing that cover up to 75% of costs. The Dutch Tax Office evaluates and grants specific tax incentives for "technical-scientific research" and "development projects". Both these countries, considered to be highly innovative, have tax schemes that are targeted at specific outcomes and there are some general exemptions for patent filings. India could perhaps learn from these policies.

Conclusion

We set out to answer two questions in this article: Are startups engaging in innovation? How innovative are startups compared to non-startup firms? Our findings using both measures indicate that startups are not driving "innovation" in the conventional sense of the term in India. However, many Indian startups have scaled up by engaging technology towards creative solutions in many industries such as payments (Paytm), e-commerce (Meesho), credit cards (CRED) and healthcare delivery (PharmEasy). While these firms may not do well on the conventional measures of "innovation", they have played a role in encouraging entrepreneurship to solve everyday challenges, all while benefiting their shareholders.[1] Policy in India must, therefore, be suitably modified to recognise such contributions towards innovation. This is an emerging idea that Indian policymakers are increasingly acknowledging. For instance, the Economic Advisory Council to the Prime Minister of India noted the importance of FDI from tech transfers as a key source of promoting innovation in India. We need to think harder about what "innovation" means in India and what role should the government play in encouraging innovation.

In further research, we will analyse the pattern of patents filed and granted across various industries to understand which sectors are more innovative in the traditional sense. We will also examine the firms that have received the IMB's certification of being "innovative" to (i) study the characteristics of these firms and the industries to which they belong, and (ii) study the trends in the grant of certification by the IMB for innovation to startups. This will help us gain a more nuanced understanding of what drives innovation among startup firms in India.

Footnotes

[1] According to its Red Herring Prospectus filed at the time of its IPO (November 2021), Paytm does not own any patents.

References

- Tom Eisenmann, Entrepreneurship: A Working Definition. Harvard Business Review, January 10, 2013.

- Stevenson, H. H., and Jarillo, J. C., A Paradigm of Entrepreneurship: Entrepreneurial Management. Strategic Management Journal, 11 (1990), 17-27.

- Dobrila Rancic Moogk, Minimum Viable Product and the Importance of Experimentation in Technology Startups, Technology Innovation Management Review, March 2012.

- Beck, Thorsten and Demirguc-Kunt, Asli and Maksimovic, Vojislav, Financing patterns around the world: Are small firms different?, Journal of Financial Economics, Volume 89, Issue 3, September 2008, Pages 467-487.

- Jue Wang. Innovation and government intervention: A comparison of Singapore and Hong Kong. In: Research Policy 47.2 (Mar. 2018), 399-412.

- Wesley M Cohen and Steven Klepper, A Reprise of Size and R&D. In: Economic Journal (1996), 106 (437), pp. 925-51.

- Gaetan de Rassenfosse, Adam Jaffe, and Emilio Raiteri. The procurement of innovation by the U.S. government. In: PLOS ONE 14 (Aug. 2019), pp. 1-11.

- Katila, R. Measuring innovation performance. In: International Journal of Business Performance Measurement (2000), 2: 180-193.

- P. A. Geroski. Entry, Innovation and Productivity Growth. In: The Review of Economics and Statistics 71.4 (1989), 572-578.

- R Rothwell and W Zegweld. Industrial Innovation and Public Policy: Preparing for the 1980s and the 1990s. In: London: Francis Pinter Publications (1981).

- G. Symeonidis, Innovation, Firm Size and Market Structure: Schumpeterian Hypotheses and Some New Themes, OECD Economics Department Working Papers, 161 (1996).

- S.A. Low and M.A. Isserman. Where Are the Innovative Entrepreneurs? Identifying Innovative Industries and Measuring Innovative Entrepreneurship. In: International Regional Science Review 38.2 (2015), 171-201.

Aneesha Chitgupi, Karthik Suresh and Diya Uday are researchers at XKDR Forum. We thank Devendra Damle, Josh Felman, Dr. R. A. Mashelkar, Amey Mashelkar, Megha Patnaik, Arjun Rajagopal, Anjali Sharma and the anonymous referees for their feedback and comments.

According to the data presented, startups accounted for only 1.2% of patents filed in the first year in the sample, but they received 3.2% of patents granted. This suggests that their patent applications may have been of higher quality than those of non-startups, as they were granted patents at a rate 2.67 times higher than justified by their filing rate. However, in the final year of the sample, startups accounted for 6.6% of filings, but only 2.3% of grants, making them 35% less likely to be granted a patent on their filing than non-startups. This sharp decline in success rates is concerning and raises questions about the quality of their filings. It would be interesting to further explore why there was such a significant drop in the quality of the filings over time.

ReplyDeleteIt takes 2-3 years for a filing to be granted a patent. For filings in 2016-17, the effects may be seen from 2018-19 onward. Until 2017, to qualify for the income tax exemption, one of the criteria was proof of a patent filing. Therefore, we may see the results on grants in 2022 and 2023. We haven't received data for these years yet.

ReplyDeleteThat is a very good point. Thank you! The fraction of patents filed by startups is going up over 2016-17 to 208-19. Meanwhile the fraction of patents granted is going down over 2018-19 to 2020-21. This still does suggest (although it is not conclusive proof) that the relative success rates are going down over this period for startups.

Deletei have been doing similar research. Can we discuss more about this. My email id is ksharm2@clemson.edu

ReplyDelete