by Aishwarya Gawali and Renuka Sane.

There are concerns that household balance sheets are under stress due to rising levels of debt. An important contributor to the composition and levels of household debt is the ability to repay loans on time. Difficulty in repaying debt is also potentially a useful indicator of stress on the household balance sheets. There is already some evidence which indicates that households, and in particular rural households, are borrowing for debt repayment to cope with this stress. We present evidence on the same, from a large-scale panel survey.

Data

Our analysis is based on data from the Consumer Pyramids Household Survey (CPHS), a pan-India panel household survey of about 174,000 households carried out by the Centre for Monitoring Indian Economy. In order to capture the latest available information from the CPHS, we use data from May to August (Wave 2) of 2022 and trace back to the same months of the preceding years. That is, we study data collected in the months of May to August (Wave 2) in each year between 2015 and 2022.

The data on sources and purposes of borrowing is sourced from the Aspirational India database within CPHS. This is our primary source of data for understanding credit access. Households are asked questions on their borrowing status across multiple sources and purposes. The responses are recorded as Yes/No, that is whether households have debt outstanding, and if so, whether households have borrowed from a specific source for a specific purpose. For example, if a household has borrowed for debt repayment, we would also get information on which source they borrowed from for debt repayment.

The data on income comes from the Household Income database which we use to create income deciles. The deciles are based on average monthly income of the five years prior to 2022.

We use household weights to get population level estimates of the share of households that have outstanding debt for the purpose of debt repayment.

Q1: How many households borrow, and how many borrow for debt repayment?

Figure 1 shows the number of households with debt outstanding, and number of borrower households who have borrowed for debt repayment. The number of borrower households increased from 17 million in 2015 to 165 million in 2022. The number of households borrowing for debt repayment rose from just 0.75 million in 2015 to 23 million in 2022. The share of borrowing for debt repayment in overall borrowing rose from 4% in 2015 to 14% in 2022.

The pandemic year of 2020 is interesting because we find that there was a decline in the number of borrower households. However, there was an increase in the number of borrower households for debt repayment. Borrower households dropped from 154 million in 2019 to 141 million in 2020; however households borrowing for debt repayment increased from 12 million in 2019 to 14 million in 2020. As of August 2022, 165 million households in India had debt outstanding. Of these, 23 million had taken a loan to repay debt.

Q2: What is the rural-urban variation in borrowing for debt repayment?

The CPHS data suggests that rural India has a larger share of borrower households than urban India. This is also borne out by the All India Debt and Investment Survey conducted by the NSSO, which shows that 35% of rural households are indebted compared to 22% in urban centres.

Figure 2 examines the rural-urban distribution of borrowing for the purpose of debt repayment. It shows two data points: the total number of borrower households in both rural and urban India, and the number of borrower households that have debt outstanding for reasons of debt repayment.

In 2015, there were about 16 million households in rural India and 9 million households in urban India that had debt outstanding. Of the 16 million in rural India, 2.26% had borrowed for debt repayment reasons. Of the 9 million in urban India, 1.35% had borrowed for debt repayment reasons. This number had increased to 12% of rural borrower households and 14% of urban borrower households in 2022. However in terms of absolute numbers, there are a lot more borrower households (overall and for debt repayment) in rural India than in urban India.

Q3: What are the sources of borrowing for households with borrowing for debt repayment?

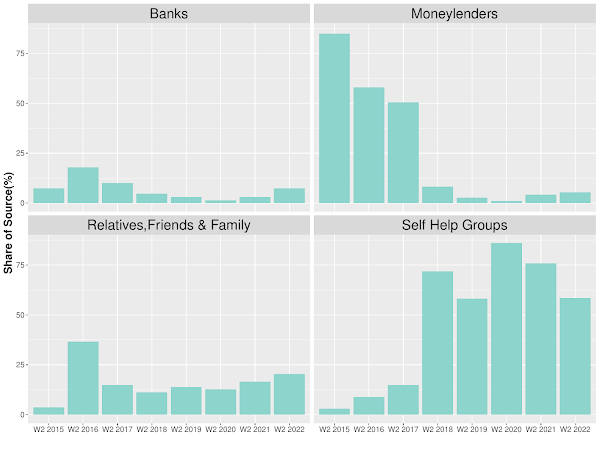

CPHS provides information on the source of borrowing for each purpose. Figure 3 presents the share of the main sources from which households have borrowed for debt repayment between 2015 and 2022.

There are two interesting patterns that emerge. First, in the earlier years, the biggest source of borrowing for debt repayment were the money-lenders. In 2015, 84% of households borrowing for debt repayment had borrowed from a moneylender. This has now flipped to self-help groups.

Interestingly, we also find that borrowing for debt repayment comes largely from Andhra Pradesh and Telangana. Perhaps the reliance on self-help groups is just a reflection of the largest share of borrower households for debt repayment being located in these regions which have a higher presence of self-help groups.

The next major source is relatives, friends and family followed by banks. It is important to note that these shares may not always add up to 100 because a household can take a loan for repayment of existing debt from more than one source.

Q4: What is the relation between income and borrowing for debt repayment?

Figure 4 plots the number of households with borrowing for debt repayment, in each income decile for Wave 2 of 2015-2022. Borrowing is higher between the fourth and eighth income decile households.

Cumulatively, the fifth, sixth, seventh and eighth deciles accounted for almost 60% of the total number of households that borrowed for debt repayment in 2022. In the eighth decile, 3.93 million households borrowed for repayment in 2022. This indicates that 17% of the households that borrowed for debt repayment belonged to the eighth decile. 15% of the total household borrowing for debt repayment was from the sixth decile, with 3.47 million borrowers. The seventh and fifth deciles followed closely with shares of 14% (3.33 million) and 13% (3.10 million) respectively.

The number of households in these deciles have also grown over the years and 2022 has the highest number of households in each decile. The lines for 2015 and 2016 are almost flat which indicates the low level of borrowing for debt repayment. The rise becomes prominent from 2017 as the gaps between the lines start to widen. This is most visible in the case of 2022, where all deciles, but especially the sixth and eighth decile saw a huge rise in borrowing for debt repayment.

Conclusion

In this article we have established some basic facts about household borrowing for debt repayment in India. First, there has been an increase in the number of borrower households, as well as the number of households who borrow for reasons of debt repayment. Second, the increase is greater in rural areas as against urban areas. Third, self help groups seem to be the most prominent source of borrowings for debt repayment. Fourth, households between the fourth and the eighth decile have the highest number of households with borrowing for debt repayment. These facts are building blocks of a larger research agenda on understanding debt and distress.

Renuka Sane is a researcher at Trustbridge and Aishwarya Gawali is a researcher at NIPFP.

borrowing for debt repayment would have simply increased in recent year because large debts were taken in previous year

ReplyDeleteThe conclusion that borrowing for repayment is more prevalent in 5th, 6th, 7th and 8th decile is not very obvious from the given graph/data. It is quite possible that these deciles have also higher number of borrowers. For example, 8th decile could also have 17% of all borrowers. Hence, even with uniform rate of repayment-borrowing across deciles, 8th decile will still have 17% of the households that borrowed for debt repayment. The relevant measure would be ratio of repayment-borrower to total borrower within each decile.

ReplyDeleteThank you for your comment. Currently, we are presenting the decile-wise number of households borrowing for debt repayment for that year. As this does not control for changes in the number of total borrower households, we also calculated the decile-wise percentage of borrowers who borrowed for debt repayment. Using this metric, we find that the shares are among the highest for 4th, 5th, 6th, 7th and 8th decile. For example, from 2018, in the 8th decile, a minimum of 13% of borrowers had borrowed for debt repayment. For the 7th decile, the minimum was 11%, for the 6th it was 9% and for the 5th and 4th it was 8% each. This goes to show that the minimum baseline for borrowing for debt repayment was higher in the mentioned deciles, and it has also increased over the years. For reference, this threshold was between just 1-4% for the other deciles. While this too rose with the years, it never reached the highs that the 4th, 5th,6th, 7th and 8th deciles did. The shares are also the highest in 2022, as expected.

Delete