by Ajay Shah and

Susan Thomas.

In 2016 and 2017, we wrote `State of the art' articles on the Indian bankruptcy reform. This article presents the third in this series, the state of the art as we see it in 2018.

A few anecdotes about IBC at work are high in the public imagination. The takeover of Bhushan Steel by Tata Steel was an unexpected output in nearly all elements of the insolvency. Bhushan Steel is a plant with a capacity of 5 million tonnes of steel per annum which was producing 3 million tonnes per annum under financial distress. Under the new management, it is expected to produce 5 million tonnes of annum. The recovery rate for creditors was an

impressive 63%. Unsecured bond holders, expecting nothing, received significant cash. Another surprising resolution was that of Sharon Bio Medicine, where the

unsecured creditors got close to 98% of their dues.

Some cases have been unpleasant surprises. Those that stand out include

Binani Cement,

Essar Steel,

Jaypee Infratech.

There has been a great deal of rumination of these cases, and other such anecdotes in the policy discourse. We try to think systematically about these questions in this article, which distills the insights of the associated literature. It is useful to think within the classification scheme of inputs - outputs - outcomes. In the case of the Indian bankruptcy reform, these three pillars map to:

- Inputs: Laws (both Parliamentary law and subordinate legislation), the institutional infrastructure that is required for the IBC to work, and capabilities of various private persons.

- Outputs: Transactions that go through the system and the performance of all parties that come together to make these transactions happen.

- Outcomes: Recovery rates, the growth of credit and the rise beyond simple secured credit, and the deeper changes in behaviour by private persons who borrow and lend. All these agents re-optimise their strategies based on their perception of the working of the bankruptcy process.

Outputs: How much time do cases take?

|

| Survivor function after a case is admitted at NCLT. Source: IGIDR FRG. |

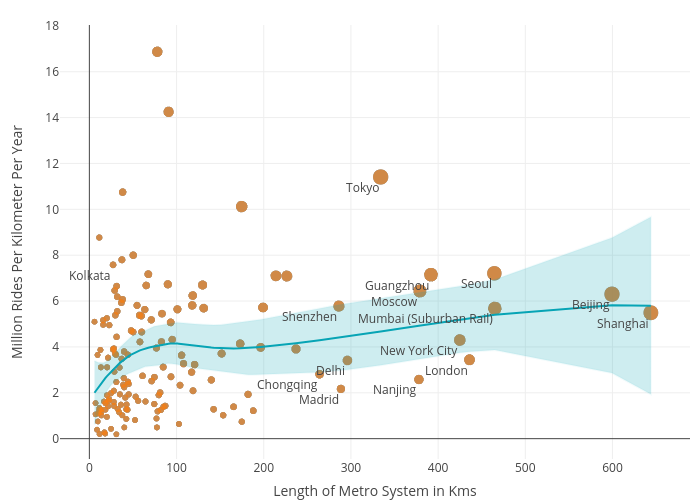

The graph above shows the `survivor function' of cases that are admitted at NCLT on date 0. At date 0, the survivor function takes the value 1, which means that 100% of the cases are pending. As time flows forward, some insolvencies are resolved. The cases that are still pending are the `survivors'; the survivor function shows the fraction of cases that are not resolved.

The IBC intended that cases would ordinarily be completed in 180 days. We see that by 180 days, there is a probability of about 0.9 that a case is not resolved.

The IBC intended that under special cases, cases could survive to 270 days. If the IBC was implemented correctly, the survivor function would be down to 0 by 270 days. We see that by 270 days, there is a probability of 0.8 that a case is not resolved.

Things are more challenging when it comes to the biggest cases. The dashed red line shows the RBI-12 firms. For these firms, none was resolved in 180 days and at 270 days, the survivor function had reached 0.9.

While 180 or 270 days may appear to be arbitrary cutoffs, they were enshrined in the Act and this should matter. A casual examination of the survivor function does not even show a kink at 180 or 270.

If, instead, we want to simply apply common sense, and wonder about what gets done in the first year after a case is admitted, the answer is: about half of all cases are resolved. But when it comes to the RBI-12, about 90% of the cases are pending, one year after admission.

From 2015 onwards, it has been clear that pulling off the IBC reform is a complex puzzle. By 2018, we are able to compute this survivor function of admitted cases, and we see that there is a problem.

Outputs: Resolution plan versus liquidated

When a firm is resolved, it can be liquidated, or it can transition into a resolution plan. When we think of the outputs of the IBC, it is useful to know the fraction of firms that fall into each of these buckets. Surprisingly, there is a third outcome: cases that are dismissed by the appellate authority. We summarise the facts here:

| As of January 2018 | As of September 2018 |

| Resolved | 26 | 52 |

| Liquidated | 134 | 212 |

| Dismissed after IRP admission | 4 | Unknown |

| Ongoing | 323 | 816 |

Outputs: A few firsts

- First case where interim financing is obtained?

- Not known. There is no public data about interim financing.

- First vote by a creditors' committee?

- Not known. There is no public data about what happens in the IRP.

- First case to complete IRP with a super-majority in favour of a restructuring plan?

- Synergies Dooray Automative Ltd.

- First case where the promoters are ejected?

- Innoventive Industries. This is a guess, as the relevant documents about the bankruptcy process are not released.

- First case to commence liquidation?

- Bhupen Electronic on 7th August 2017.

- First case to complete liquidation?

- None.

- First individual insolvency that commenced?

- Provisions for individual insolvency are not yet notified

Outcomes: Important gains are taking place outside the public eye

The IBC is delivering poor outputs. Particularly with large firms, the institutional arrangements do not deliver rapid resolution. There is increasing gloom surrounding the bankruptcy process for large firms. When enough money is at stake, it is efficient for persons to spend millions of rupees of lawyers per year, and obtain delays through litigation.

While this is the case, the IBC is delivering important gains, outside the public eye: It is reshaping the behaviour of borrowers.

Private negotiations are always more efficient and reach better outcomes when compared with the formal process of bankruptcy law. In out-of-court negotiations, debtors and creditors have more flexibility on the structure of the resolution than when under the watchful eye of the IBC adjudicator. For instance, efficient resolution plans will involve various schemes under the Companies Act (Sections 230-234, Companies Act 2013), which are already available to the stressed firm. What the IBC does is to provide the threat of the worst case scenario. Numerous private negotiations take place under the shadow of IBC:

- Shareholders of many stressed firms would sell off the business, or obtain fresh equity capital, at an early stage of distress, when they know how things are going to work out under IBC.

- There is anecdotal evidence that firms are behaving better with regard to financial and operational creditors, now that the threat of IBC is in the picture. The IBC helps set the stage for a better renegotiation between the borrower and the lenders.

These gains are among the desired

outcomes of the bankruptcy reform. Since they tend to be invisible to the public eye, they tend to generate no news stories. For this reason, the gains for India owing to the bankruptcy reform tend to be understated.

One area where this learning by Indian promoters may be seen in the quick negotiations and settlement of cases

after an IBC filing. This is seen in the

FRG Insolvency Cases Dataset : Of the 830 cases for which were final orders were passed by the NCLT till 30 November 2017, 137 were dismissed as settled.

We should focus on how the incentives of promoters are changed. For these agents, the important issue is:

Will we be harmed if we default?. The IBC is likely faring well on this, even if only a small fraction of large cases are resolved in a year.

In this thinking, it is important to distinguish between the stock of defaulted firms and a decision made from today onwards about default. For the stock, IBC induces fresh thoughts in negotiation for all parties. For the future, borrowers see their prospects after default, and are less likely to default.

Inputs: the law

Amendments to the law have been energetically pushed out. A first amendment was in January and a second in August of 2018. But the law remains a work in progress in many ways. Gaps between the text of the law and the design principles of the BLRC continue to cause problems in the other elements listed ahead. Further, some of the amendments have become the source of new problems in the smooth functioning of the law. Three major issues concern the inclusion of home buyers as financial creditors, the change in the threshold of cramdown from 75 percent to 66 percent, and the 29A amendments ruling out the debtor from providing a resolution plan during the Insolvency Resolution Process.

A short while after the first 12 large cases came into the IBC, Section 29 was modified to keep the promoter out of the resolution process. Under the new arrangement, promoters know a lot about the business and lack incentive to give this knowledge to new owners. This is value destroying (Choudhary, 2018). Further, promoters may have little incentive to preserving value once it becomes clear that a firm is headed towards default. In the extreme scenario, promoters may accelerate cash extraction if they see a world where theft goes unpunished and default leads to a loss of control of the company. At the same time, participants in the IRP are unlikely to compete with the promoter, so keeping the promoter at a distance from the IRP may give confidence to others who are interested in taking over the enterprise. In the BLRC design, it was important to differentiate between promoters who were guilty of theft and fraudulent practices from those who were not. However, there has been little focus on the provisions where the resolution professional can identify fraud in the accounts of the firm, which should have been a pathway to debar the promoter from any further involvement with the stressed firm.

Conceptual thinking on the exclusion of promoters from the bankruptcy process came out after 29A was enacted (Feibelman and Sane, 2017; Sengupta and Sharma, 2017; Shah, 2017). As argued by these articles, 29A has given unanticipated effects, and an escalation of delays in the bankruptcy process. Private detectives all over India are ferreting out family connections and defaulted businesses of the Indian business elite. This section has become a tool for competitors to hinder the resolution of a distressed company.

Many amendments of the law, such as 29A, are based on practical considerations and lack conceptual coherence or grounding in the empirical evidence. The desire for good outcomes, at the level of one anecdote at a time, has given bad outcomes on the overall distribution. An example of this lies in the tension between recovery rate in one particular case versus the sanctity of process. We have been too quick to jettison the sanctity of process. While this may seem nice at the level of a certain case, it undermines the incentives of participants to take the IBC process seriously, and to commit long-term resources in their participation (Shah, 2018).

Inputs: the IBC institutional infrastructure

The law required four new elements of institutional infrastructure to become operational. Given such a burden of requirement, it is quite a remarkable feat of implementation that within six months of the law being passed, the first cases were being filed under this new law. The adjudication authority, the National Company Law Tribunal, was already in place by the time that the law was passed. So, the front-runner in institutional development was the Insolvency and Bankruptcy Board of India, IBBI, which was up and running on the 1st of October, 2016. After that, came the Insolvency Professional Agencies, IPAs, and the Insolvency Professionals, IPs. The Information Utilities or the IUs, are yet to make their presence felt.

- The regulator and the subordinate legislation

- The regulator has been one of the four institutions under the law that has performed well in its startup phase. But now that this phase is behind us, there is a need to strengthen institutional capabilities and feedback loops between the regulator and the rest of the insolvency ecosystem (Khurana, 2017). The checks and balances described in Roy et. al. (2018) need to be put into the law to ensure accountability. The regulation-making process needs to rise from fire-fighting and practical thinking and to evidence-based and research-based thinking. IBBI is at the Indian frontier, on the sound working of regulators, by binding itself to a sound regulation-making process. At the same time, a research-driven regulation-making process requires a commensurate statistical system and a research community, both of which are at present lacking.

- The IPA industry and the IP industry

- The IPA industry is still to establish itself as a competitive industry, where the IPA plays a regulatory role. The BLRC had visualised the IPAs would play a regulatory function that is akin to what NSE and BSE do in the brokerage industry, and this has not arisen. The IBBI has recognised the difficulties and is now exploring the SEBI approach to financial market infrastructure institutions. On the other hand, a large IP industry has developed, with IPs often being placed into complex situations that they are poorly prepared for. As an example, Shrivastava, 2018, brings back remarkable tales from the field, where learning by doing is taking place. However, in the absence of IPA capability, IPs remain largely unregulated. The relationship between the Committee of Creditors, IPs and promoters have not yet been clarified in the minds of all three kinds of participants. The IPs have often been deferential to promoters. Under the IBC, the IP is supposed to choose whether to conduct a forensic audit, to look back in the recent two years for malfeasance in the form of cash extraction from the business. There is little evidence of IPs having done this. We are able to see one example: The IP of Binani Cements conducted a forensic audit into the affairs of the company and has filed an application before the NCLT alleging diversion of funds by promoters (Lavi, 2018). Since IBBI was constituted, no IPA has taken action against an IP, and only 4 final orders have been passed by its Disciplinary Committee.

- The IU industry

- The Information Utilities are an important institutional feature of the law that has yet come into being. Participation in this industry has been hobbled through restrictions in regulations and concerns about legal liability of the IU. The block of Parliamentary law required for the IU industry to work properly has not come about. While the BLRC had envisioned a private, competitive IU industry, there are attempts to create a monopoly IU by the RBI (Regy, 2017). Public sector monopolies tend to work poorly and the attempt to establish a Public Credit Registry can further derail the nascent IU industry.

- Adjudication

- The block of Parliamentary law required for the NCLT to work properly has not come about. As a consequence, the NCLT has taken shape like a conventional Indian tribunal. The case load has started generating a back log and delays at NCLT, due to capacity constraints. The BLRC vision was for the adjudication to not engage in commercial decisions during the process of insolvency resolution. NCLT, and amendments to the law, are bringing NCLT back into commercial decisions (Datta and Sengupta, 2017; Feibelman, 2018). The NCLT and other courts have now begun using their adjudication powers to favour resolution as opposed to liquidation; re-bids are being allowed and even resolution is being given another chance. This is a disruption for the efficiency of the bankruptcy process. The NCLT has also taken the view that piecemeal sale of assets is not allowed even though the IBC does not expressly prohibit such a practice. Before the relevant amendments were brought in, the Supreme Court (and even NCLTs) was allowing settlement of cases after admission, something that was not provided for under the IBC as it existed. Each such event creates a flawed jurisprudence, and harms the objectives of the Indian bankruptcy reform.

Three of the four institutions under the IBC took off at an admirable pace. However, under the combination of being tasked to deal with cases not under its domain (such as the defaults to home buyers which would have been more optimally dealt with under the Real Estate (Regulation and Development) Act, 2016) or with large cases in its infancy (such as the large 12 cases that the RBI placed into the IBC in 2017) and being inadequately resourced to deal with this jump in workload, the institutions are predictably beginning to show delays in performance.

Inputs: The creditors

One of the most important features of the law is the power that is given to the creditor in the phase of insolvency resolution. Our articles in earlier years raised concerns about the incentives of lenders and the efficiency of their choices, given the weaknesses of banking regulation and the dominance of public sector banks. These concerns remain:

- The lack of organisational capacity in banks, to make decisions, persists. Process failures are apparent when representatives of public sector banks claim to have no final decision making authority at meetings, a carry-over from their role during the CDR scheme process. As a result, they abstain from voting. In extreme circumstances, there have been votes by these representatives that are not upheld by their managements. The IBBI has tried to allay this concern by imposing an obligation on the resolution professional to ensure that only authorised representatives are present at the creditor meetings. It is yet to be seen how much the financial creditors cooperate with the resolution professional.

- Banking regulation continues to be an important constraint shaping the behaviour of banks on the Committee of Creditors (CoC). A resolution plan that delivers value of anything less than what the bank is presently carrying as the asset value in its books, is likely to be rejected. The RBI continues to coerce banks to use the IBC, but this is the wrong solution (Zaveri, 2018). The February 2018 diktat by the RBI which requires cases with more than aggregate exposure of Rs. 20 billion and above to be compulsorily referred to IBC after 180 days of failed negotiations is another coercion that does not centrally address the incentive problems created by banking regulation. Instead, more technically sound regulation at RBI is essential, where assets are always marked down sharply, so that the bank looks forward to the (small) payout from the bankruptcy process as a source of new net profit. If banking regulation forces a bank to write down a Rs.100 loan to 0, then the bank will vigorously pursue obtaining (say) Rs.10 in the insolvency resolution process. Without it, a bank dominated CoC will end up providing tacit support for any alternative to accepting a market price that is lower than regulatory valuation -- and the easiest option is delay.

- Auctions are not an appropriate mechanism for collective resolution. A consequence of bank dominated creditor committees is an excessive attempt to reduce decision making into a formulaic process, close to the procurement processes followed by the government. As an example, IBA has come out with a bid evaluation matrix. Such a framework has a focus on a single number quoted by the bidder in an auction (Mehta, Sinha, 2018). Auctions are important during the liquidation stage, but not in resolution (Doshi, 2018). Auctions work well in cases with low complexity of credit structures. But the typical insolvency case will have complex financial obligations and asset structures. While the public sector bank dominated committees will take comfort that a standard procedure will rescue them from potential CVC scrutiny later, the use of such a mechanical procedure is likely to deliver sub-optimal business outcomes. Ironically, such outcomes increase the chances of a future inquiry. This problem is not a feature of public sector banks only. Matters have been made harder through a Supreme Court ruling in February 2016 that employees of private banks will be treated as `public servants' for the purposes of the Prevention of Corruption Act. This has made private bank employees behave more like public servants.

- Auctions may be an appropriate mechanism for individual corrective action. If a public sector bank is unable to engage in commercial, speculative, forward-looking thinking, better outcomes will be obtained by selling off distressed debt through auctions. Unlike the complexity of the commercial decisions that a member of the CoC has to take, the sale of distressed assets can be the outcome of of simply running an auction and choosing the highest bidder. Here too, banking regulation may hold the key. If a stressed loan of Rs.100 is marked down to 0, and a bank sees an up side potential of Rs.20 by selling off the loan versus an up side potential of Rs.10 by going onto the CoC itself, then rationality will prevail. If, on the other hand, the regulatory valuation of the asset (in this example) is Rs.30, then the best strategy for the bank is to do nothing.

Inputs: The buyers

For high recovery rates, there should be a large base of participants in the IRP from outside the existing creditors and debtor. There have to be interim finance providers, specialists in managing financial stress who can buy loans and debt securities from creditors who have lower appetite in holding those assets, as well as buyers who are specialists in resolving business stress itself. The Indian credit ecosystem has relatively few participants who can play these multiple roles. As a consequence, the existing evidence on transactions in the IRP stage currently present a skewed and stunted picture:

- The present legal framework constrains the sale of stressed bank loans only to the Asset Reconstruction Companies (ARCs), who in turn have to hold a fixed fraction (15 percent) of these assets in their book. There are a limited number ARCs, holding a limited amount of capital that is available to purchase stressed loans. This increases the cost of a resolution both because of higher delays (going through an ARC will necessarily increase the time taken to participate) and higher costs (a transaction through an intermediary introduces an additional layer of cost, compared to directly transaction with the debt holder).

- A standard approach taken during the IRP is to aggregate a sufficient base of the credit, so as to control and manage the decision of the committee of creditors. There appears to be significant uncertainty in what constitutes the liabilities of the stressed entity, which in turn decides the weights that various creditors hold in the committee of creditors. For example, IDBI Bank which was a creditor in the Binani Cements IRP had their weights in the committee of creditors adjusted upwards at a significantly advanced stage of the bidding process. This creates delays and deters outside participants. There is similar uncertainty in identifying the assets that are available in the stressed entities. The IUs were intended to have solved these problems, but the IUs have not materialised.

- Many financial and non-financial firms have expended resources on developing bids, only to face failure for unreasonable reasons such as a deviation from the process defined in the law. This has generated reduced interest from prospective participants. In numerous recent experiences, the IRP seems to obtain only one or two bids. Many private equity funds or large listed companies have seen the difficulties of the IBC and made a conscious call to avoid IRP participation.

- We are still at the early stages of a process where new financial firms such as private equity funds have successfully completed a stressed asset transaction. After such experience builds up, dedicated stressed asset funds come about and succeed, and then a great wave of capital comes in. This process is still many years away, given the paucity of credible outcomes so far.

An input that is lacking: a knowledge rich environment

A recurrent theme disrupting a smooth path towards easier participation and higher certainty of outcomes is a lack of abundant, commonly available data. Defaulting firms, lenders, IPs, IBBI and NCLT have disparate facts about transactions, and systems for dissemination do not yet exist to bring these all together. The few initiatives on data release tend towards being practitioner oriented: e.g. the user has to supply a case docket number. There are no public systems that release machine readable data-sets that can be used for research. The BLRC design for the bankruptcy process was based on a central assumption of improved access to information. This is a missing piece of infrastructure in the evolving IBC ecosystem.

Where is data for the working of the Code coming from? The most readily and consistently accessible source of such information is the set of orders that are issued by the NCLT at various stages that an admitted case goes through in the process towards resolution. The data-set of cases collated in the

FRG IBC dataset is collated after analysing the cases with orders posted at the NCLT website about admission or dismissal into the IRP. The second source of information is a similar collection of orders

IBBI website and information derived from these orders in the

IBBI newsletters. The data dissemination systems are not perfectly synchronised yet. There are gaps observed between the derived data in the IBBI newsletters compared to the source NCLT orders.

For listed companies, the core principle of securities law is that all information that shapes the thinking of speculative traders should be disclosed rapidly to the market. The existing principles-based SEBI LODR correctly embeds this principle. But today, neither defaulting listed companies nor listed lenders are disclosing default events, at what stage of the resolution process they are at in the IBC, the details of chosen resolution plan, etc. (Shah and Zaveri, 2018). In such an environment, there is little published research on the Indian bankruptcy reform. Initiatives like Chatterjee et. al. (2018), where the authors hand-construct a data-set and analyse it, are valuable but rare.

Given the lack of data, the field is dominated by anecdote, practitioner experience and media coverage. Decision making by practitioners and policy makers tends to pursue outliers. While such seat of the pants thinking does generate certain self-correcting mechanisms, the pace of learning is inefficient. Sengupta and Sharma, 2018, have built an annotated reading list which pulls together the extant literature. A lot more is required by way of data and research, to strengthen this literature.

The return of nurturing

The Bankruptcy Legislative Reforms Committee (BLRC) is explicit on the purpose of the bankruptcy code: it is to achieve a rapid

resolution. Whether this takes the form of debt restructuring, enterprise restructuring, or enterprise liquidation is not important. The key point is to rapidly resolve the enterprise failure that is visible at default, and to release capital.

In recent months, we see a return to the old rhetoric of SICA and BIFR, where the desired outcome was the continued survival of the firm, and that there are persons other than the committee of creditors who should have a say in the commercial decisions that the law put in the hands of this committee. The term `stakeholders' is being used a lot. The judiciary, for instance, is assuming roles in deciding

who is eligible to be a resolution applicant, is demanding

progress reports during the resolution phase, is deciding whether

fresh bids need to be submitted and is even providing a

fresh opportunity at revisiting resolution proposals even after the expiry of 270 days.

This is antithetic to the concept of bankruptcy of firms. If such ideas gather momentum, they could potentially feed into the future decisions of judges, regulatory staff or law makers. This would derail the 2016 attempt at Indian bankruptcy reform. The essence of a well functioning bankruptcy process is that the only focus of the committee of creditors should be upon their own financial performance. There should be no deviation from this ethos of a market-based economy.

Conclusion

The Indian bankruptcy reforms, unlike in most other countries, have been developed top down rather than bottom up. The bankruptcy process requires an institutional infrastructure: the law, IBBI, subordinate legislation, IPAs, IPs, IUs, organisational capabilities in lenders, a wide pool of buyers. The skills and institutions that ought to have emerged out of the needs of financiers and enterprises, have been forced into being by creating them by law. In two years since the start of the reforms, institutions that have a well-defined role in the process of insolvency resolution have been rapidly developed and deployed to carry out their tasks (the regulator, the adjudicator and the insolvency professional). Those institutions that can be substituted for are yet to get the stimulus and support for development (IPA, IUs).

Into this fragile, relatively unproven institutional infrastructure, when large cases were placed, we engaged in premature load bearing (Shah, 2018). As a consequence, only five of the 40 large cases have emerged from the IBC process. This yet-nascent system continues to grapple with delivering the equilibrium that the law was created to deliver. We are still at the early stages of revelation of the Indian corporate credit crisis. There is a large pool of distressed companies in India (Shah and Sinha, 2018), which will start to trickle into the bankruptcy process, when private negotiations with financial or operational creditors break down.

The bankruptcy reform has yielded valuable gains in the behaviour of borrowers, both towards financial creditors and towards operational creditors. One hard political economy problem -- of establishing the apparatus through which the divine right of promoters is questioned -- has been achieved. But a bankruptcy process which reliably goes from a default to a solution within six to nine months remains elusive.

The way forward lies in building data-sets and knowledge, and high quality policy teams, which will carry this work program forward on all the multiple fronts described above, both within the IBBI and outside of it. As with many other parts of Indian economic reform, the centre of the puzzle lies in establishing feedback loops, from evidence to research to policy.

Acknowledgements

We thank Josh Felman, Sumant Batra, Varun Marwah, Gausia Shaikh, Anjali Sharma and Rajeswari Sengupta for useful discussions. We thank all participants at the

IBBI-IGIDR-FICCI Insolvency and bankruptcy reforms workshop, the

Insol India 2018 conference, the

IBBI-IGIDR Insolvency and bankruptcy reforms conference and the

EMF 2018 for shaping the thinking.

References

Chatterjee et. al., 2018.

Watching India's insolvency reforms: a new dataset of insolvency cases, Sreyan Chatterjee, Gausia Shaikh and Bhargavi Zaveri, National Law School of India Review, September 2018.

Choudhary, 2018.

Insolvency and Bankruptcy Code -- Role of Promoters in Resolution Process, S.G Choudhary, Business Economics, January 2, 2018.

Datta and Sengupta, 2017.

Commercial wisdom to judicial discretion: NCLT reorients IBC, Pratik Datta and Rajeswari Sengupta, The Leap Blog, December 13, 2017.

Doshi, 2018.

IBC: Why Resolution Plans Are Unsuited To An Auction According To India's Insolvency Regulator IBBI's Sahoo, Menaka Doshi, Bloomberg Quint, May 1, 2018.

Feibelman, 2018.

A Limiting Principle for the NCLT's New Powers Under the IBC, Adam Feibelman, The Leap Blog, August 1, 2018.

Feibelman and Sane, 2017.

Don't rush to ban promoters from the IBC process, Adam Feibelman and Renuka Sane, The Leap Blog, November 17, 2017.

Khurana, 2017.

Pieces of a complex solution: Insolvency and Bankruptcy Code, Reshmi Khurana, The Hindu, June 28, 2017.

Lavi, 2018.

A code for the broke, Mohan Lavi, The Hindu, March 28, 2018.

Mehta, Sinha, 2018.

Balancing interests under the IBC, Zubin Mehta, Amrita Sinha, Livement, July 16, 2018

Regy, 2017.

RBI's proposal for a Public Credit Registry, Prasanth Regy, The Leap Blog, August 2, 2017.

Roy, et. al, 2018.

Building State capacity for regulation in India by Shubho Roy, Ajay Shah, B. N. Srikrishna and Somasekhar Sundaresan. In Devesh Kapur and Madhav Khosla (eds.), "Regulation in India: Design, Capacity, Performance" (Forthcoming, 2019). Oxford: Hart Publishing.

Sengupta and Sharma, 2018.

An annotated reading list on the Indian bankruptcy reform, 2018, Rajeswari Sengupta and Anjali Sharma, The Leap Blog, August 14, 2018.

Sengupta and Sharma, 2017.

Understanding the recent IBC (Amendment) Ordinance, 2017, Rajeswari Sengupta and Anjali Sharma, The Leap Blog, December 7, 2017.

Shah, 2014.

Have Indian banks been underpricing corporate loans?, Ajay Shah, The Leap Blog, December 7, 2014.

Shah, 2018.

Sequencing issues in building jurisprudence: the problems of large bankruptcy cases, Ajay Shah, The Leap Blog, July 7, 2018.

Shah, 2018.

Concerns about the Indian bankruptcy reform, Ajay Shah, The Leap Blog, March 25, 2018.

Shah, 2017.

What is the right role for promoters in the bankruptcy process?, Ajay Shah, The Leap Blog, December 9, 2017.

Shah, Sinha, 2018.

Credit stress in large Indian firms, Ajay Shah and Pramod Sinha, The Leap Blog, November 21, 2018.

Shah, Thomas, 2017.

The Indian bankruptcy reform: The state of the art, 2017, Ajay Shah and Susan Thomas, The Leap Blog, July 13, 2017.

Shah, Thomas, 2016.

Indian bankruptcy reforms: Where we are and where we go next, Ajay Shah and Susan Thomas, The Leap Blog, May 18, 2016.

Shah, Zaveri, 2018.

Disclosure of default: The present SEBI disclosure regulation is adequate, Ajay Shah and Bhargavi Zaveri, The Leap Blog, January 11, 2018.

Shrivastava, 2018.

Kidnappers, Angry Workers Plague A $210 Billion Debt Cleanup, Bhuma Shrivastava, Bloomberg Quint, Jul 27, 2018.

Zaveri, 2018.

The Centre's approach to Insolvency and Bankruptcy Code has costs, Bhargavi Zaveri,

Mint, June 14, 2018.