Today, Jaimini Bhagwati has an article in Business Standard on the IPO process in India. He emphasises the political dimension, where investment bankers have the most to lose if the IPO is disintermediated. Interestingly enough, a recent working paper says that IPO underpricing has not changed in London after 1914. I see this as evidence that the investment bankers have been able to hang on to their rents. (I have written about the IPO process before; So far there doesn't seem to be any progress towards fixing it).

Search interesting materials

Wednesday, May 31, 2006

Friday, May 26, 2006

Woes of the corporate bond market

India is a strange mixture of extremely active trading in equities, very little leverage by firms, and a very small corporate bond market. It's odd: given how deeply related the securities issued by one firm are, liquidity for one kind of contingent claim about a firm ought to easily translate to liquidity for correlated products. Last year, the R. H. Patil report proposed some new ideas on how to jumpstart the corporate bond market. This is being implemented at SEBI. You think it ought to be simple? No such luck!

The 18 April policy statement (para 135) by Y. V. Reddy said that RBI would constitute a Working Group to examine the relevant recommendations and suggest a roadmap for implementation. Consultation will be held with SEBI and IRDA as appropriate. Is this back to turf conflicts? On the other hand, this might merely reflect an honest effort by RBI to implement work required at RBI - e.g. on solving problems of banking regulation.

There have been many media reports that SEBI's idea of carrying this through involves giving BSE a monopoly on trading in corporate bonds. E.g. see a column in DNA about it. Today, Business Standard has an edit on the subject. This is faintly reminiscent of the efforts that might be underway at SEBI in connection with the problem of Regional Stock Exchanges (RSEs) to get RSE-subsidiary-brokerage-firms to stop trading on NSE. It also links up with recent discussions on this blog about competition between exchanges.

Tuesday, May 23, 2006

Two years of the UPA

The UPA has finished two years, and things look gloomy (Shankar Acharya). The achievements of the UPA include:

- Quotas in schools; threats of reservation in the private labour market

- Mandal-style conflicts all over again (politics)

- The fundamental threat to public finance posed by SEZs

- The 6th pay commission

- The Arjun Sengupta report (Gautam Bhardwaj, Susan Thomas, Sunil Jain).

- The stalled PFRDA Bill

Global factors are part, though not all, of the story. A global `emerging-markets-factor' appears to have taken a beating. India and South Korea are more liquid, when compared with other emerging markets, so these two countries are likely to both do well when times are good and do badly when times are bad. The second thing that seems to have changed is global risk expectations. The VIX is back up to 18%, after slumbering for months at around 12%. I don't fully understand what a higher implied volatility on the S&P 500 does to global general equilibrium.

Ila Patnaik argues that while there are serious problems in the world, the current gloom on Indian stock prices is substantially derived from domestic problems, and less from global factors. Business Standard has two excellent editorials, one ruminating about what has happened to the UPA, and another interpreting recent movements in the stock market.

As with May 2004, a lot is made of margin calls generating positive autocorrelations. The story told is: market goes down, then margin calls hit, and market goes down further. This is plain wrong because derivatives trading is a zero sum game. For each person bleeding a marked-to-market loss promising himself he will never trade again, there is another with a marked-to-market profit. who feels he is a hero who made the right call. In fact, May 2006 was a bit easier on the risk management systems as compared with May 2004, for two reasons. First, the biggest move we have seen in this episode was smaller. Second, margins went up over a period of a few days in response to a slow escalation of volatility. In contrast, in May 2004, margins went up more suddenly.

Monday, May 22, 2006

Barriers to innovation

India is fertile ground for finance in the sense that a very large number of people are capable and interested in doing complex financial transactions, such as speculation or arbitrage. This ought to be a place where you try new things, where innovations are attempted, and many novel things work.

But far from it. Most of the time, the legal and regulatory structures (RBI, SEBI, FMC, SEBI Act, SC(R)A, FC(R)A, RBI Act, etc) are stacked against innovation. We are supposed to be a common law country. But actually, things have deteriorated into something like civil law, in that every detail about a proposed transaction has to be written into the law, and a transaction is illegal unless specifically mentioned in the law. This stifles innovation.

Consider a trivial innovation: an exchange traded fund which holds gold. An ordinary ETF holds a basket of shares. An ETF on gold holds gold in some form, such as warehouse receipts. Benchmark invented the idea of an ETF on gold in 2002. They got the runaround from RBI and SEBI. So far, the product has not yet been launched. They were the pioneers in thinking this up, but in the period after 2002, a few gold ETFs have been launched outside India, ahead of Benchmark.

Vikas Dhoot has a story in Indian Express about the problems faced in doing an offshore ETF on Indian equity. It is a generic story of barriers to doing new things, and is also an example of the efficiency costs associated with capital controls.

P. B. Mehta's letter of resignation from the knowledge commission

Today (21 May), P B Mehta resigned from the `National Knowledge Commission'. This is his open letter of resignation.

Honorable Prime Minister,

I write to resign as Member-Convenor of the National Knowledge Commission. I believe the Commission's mandate is extremely important, and I am deeply grateful that you gave me the opportunity to serve on it. But many of the recent announcements made by your government with respect to Higher Education lead me to the conclusion that my continuation on the Commission will serve no useful purpose.

The Knowledge Commission was given an ambitious mandate to strengthen India's knowledge potential at all levels. We had agreed that if all sections of Indian society were to participate in, and make use of the knowledge economy, we would need a radical paradigm shift in the way we thought of the production, dissemination and use of knowledge. In some ways this paradigm shift would have to be at least as radical as the economic reforms you helped usher in more than a decade ago. The sense of intellectual excitement that the Commission generated stemmed from the fact that it represented an opportunity to think boldly, honestly and with an eye to posterity. But the government's recent decision (announced by Honorable Minister of Human Resource Development on the floor of Parliament) to extend quotas for OBC's in Central institutions, the palliative measures the government is contemplating to defuse the resulting agitation, and the process employed to arrive at these measures are steps in the wrong direction. They violate four cardinal principles that institutions in a knowledge based society will have to follow: they are not based on assessment of effectiveness, they are incompatible with the freedom and diversity of institutions, they more thoroughly politicize the education process, and they inject an insidious poison that will harm the nation's long term interest.

These measures will not achieve social justice. I am as committed as anyone to two propositions. Every student must be enabled to realize their full potential regardless of financial or social circumstances. Achieving this aim requires radical forms of affirmative action. But the numerically mandated quotas your government is proposing are deeply disappointing, for the following reasons:

First, these measures foreclose any possibility of more intelligent targeting that any sensible program should require. For one thing, the historical claims of the Scheduled Castes and Scheduled Tribes and the nature of the deprivations they face are qualitatively of a different order than those faced by Other Backward Castes, at least in North India. It is plainly disingenuous to lump them together in the same narrative of social injustice and assume that the same instruments should apply to both. It is for this reason that I advocated status quo for Scheduled Castes and Scheduled Tribes until such time as better and more effective measures can be found to achieve affirmative action for them.

Some have proposed the inclusion of economic criteria: this is something of an improvement, but does not go far enough. What we needed, Honorable Prime Minister, was space to design more effective mechanisms of targeting groups that need to be targeted for affirmative action. For instance, there are a couple of well designed deprivation indexes that do a much better job of targeting the relevant social deprivations and picking out merit. The government's action is disappointing because you have prematurely foreclosed these possibilities. In foreclosing these possibilities the government has revealed that it cares about tokenism more than social justice. It has sent the signal that there no room for thinking about social justice in a new paradigm.

As a society we focus on reservations largely because it is a way of avoiding doing the things that really create access. Increasing the supply of good quality institutions at all levels (not to be confused with numerical increases), more robust scholarship and support programs, will go much further than numerically mandated quotas. When you assumed office, you had sketched out a vision of combining economic reform with social justice. Increased public investment is going to be central to creating access opportunities. It would be presumptuous for me to suggest where this increased public investment is going to come from, but there are ample possibilities: for instance, earmarking proceeds from genuine disinvestment for education will do far more for access than quotas. We are not doing enough to genuinely empower marginalized groups, but are offering condescending palliatives like quotas as substitute. All the measures currently under discussion are to defuse the agitation, not to lay the foundations for a vibrant education system. If I may borrow a phrase of Tom Paine's, we pity the plumage, but forget the dying bird.

Second, the measures your government is contemplating violate the diversity principle. Why should all institutions in a country the size of India adopt the same admissions quotas? Is there no room at all for different institutions experimenting with different kinds of affirmative action policies that are most appropriate for their pedagogical mission? How will institutions feel empowered? How will creativity in social justice programs be fostered, if we continue with a `one size fits all' approach? Could it not be that some state institutions follow numerically mandated quotas, while others are left free to devise their own programs? The government's announcement is deeply disappointing because it reinforces the cardinal weakness of the Indian system: all institutions have to be reduced to the same level.

Third, and related to diversity, is the question of freedom. As an academic I find it to be an appalling spectacle when a group of Ministers is empowered to come up with admissions policies, seat formulas for institutions across the country. While institutions have responsibilities and are accountable to society, how will they ever achieve excellence and autonomy if basic decisions like who should they teach, what should they teach, how much should they charge, are uniformly mandated by government diktat? As you know, more than anyone else, the bane of our education institutions is that politicians feel free to hoist any purpose they wish upon them: their favorite ideology, their preferred conception of social justice, their idea of representativeness, or their own men and women. Everything else germane to a healthy academic life and effective pedagogy becomes subordinate to these purposes. Concerned academics risked a good deal battling the previous government's instrumental use of educational institutions for ideological purposes. Though your objectives are different, your government is sending a similar message about our institutions: in the final analysis, they are playthings for politicians to mess around with. Nations are not built by specific programs, they are built by healthy institutions, and the process by which your government is arriving at its decisions suggests contempt for the autonomy and integrity of academic life. Your government has reinforced the very paradigm of the State's relations with educational institutions that has weakened us.

In this process, the arguments that have been coming from your government are plainly disingenuous. It is true that a constitutional amendment was hastily passed to overturn the effects of the Inamdar decision. At the time I had written that the decision was property rights decision that was trying to unshackle private institutions from an overbearing state. But since the state had already displaced its responsibilities to the private sector it decided that the ramifications of Inamdar would be too onerous and passed a constitutional amendment. One can quibble over whether this amendment was justified or not. But even in its present form it is only an enabling legislation. It does not require that every public institution have numerically mandated quotas for OBC's. To hear your government consistently hiding behind the pretext of the constitutional amendment is yet another example of how we are foreclosing the fine distinctions that any rigorous approach to access and excellence requires.

Finally, I believe that the proposed measures will harm the nation's vital interests. It is often said that caste is a reality in India. I could not agree more. But your government is in the process of making caste the only reality in India. Instead of finding imaginative solutions to allow us to transcend our own despicable history of inequity, your government is ensuring that we remain entrapped in the caste paradigm. Except that now by talking of OBC's and SC/ST's in the same narrative we are licensing new forms of inequity and arbitrariness.

The Knowledge Economy of the twenty first century will require that participation of all sections of society. When we deprive any single child, of any caste, of relevant opportunities, we mutilate ourselves as a society and diminish our own possibilities. But, as you understand more than most, globalization requires us to think of old objectives in new paradigms: the market and competition for talent is global, institutions need to be more agile and nimble, and there has to be creativity and diversity of institutional forms if a society is to position itself to take advantage the Knowledge Economy. I believe that the measures your government is proposing will inhibit achieving both social justice and economic well being.

I write this letter with a great deal of regret. In my colleagues on the Knowledge Commission you will find a group that is unrivalled in its dedication, commitment and creativity, and I hope you will back them in full measure so that they can accomplish their mission in other areas. I assure you that the Commission's functioning will suffer no logistical harm on account of my departure.

I recognize that in a democracy one has to respectfully accede to the decisions of elected representatives. But I also believe that democracies are ill served if individuals do not frankly and publicly point out the perils that certain decisions may pose for posterity. I owe it to public reason to make my reasons for resigning public. I may be wrong in my judgment about the consequences of your government's decisions, but at this juncture I cannot help but concluding that what your government is proposing poses grave dangers for India as a nation. On this occasion I cannot help thinking about the anxieties of a man who knew a thing or two about constitutional values, who was more rooted in politics than any of us can hope to be, and who understood the distinction between statesmanship and mere politics: Jawaharlal Nehru. He wrote, "So these external props, as I may call them, the reservations of seats and the rest - may possibly be helpful occasionally, but they produce a false sense of political relation, a false sense of strength, and, ultimately therefore, they are not so nearly important as real educational, cultural and economic advance which gives them inner strength to face any difficulty or opponent." Since your government continues to abet a politics of illusion, I cannot serve any useful purpose by continuing on the Knowledge Commission under such circumstances.

(And here is Andre Beteille's letter of resignation).Friday, May 19, 2006

The two currency peggers

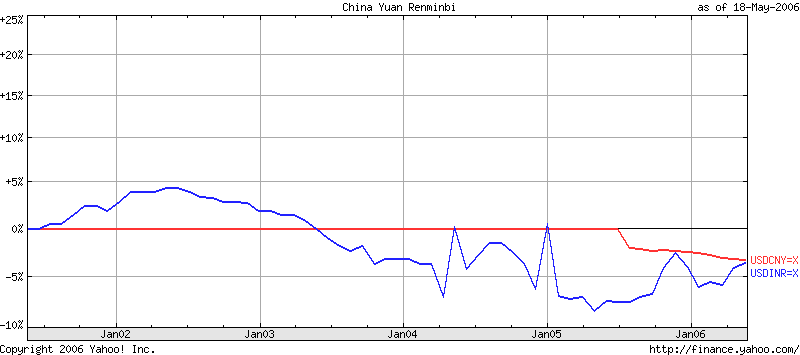

Here's a comparison of the Indian and Chinese currencies, over the last five years:

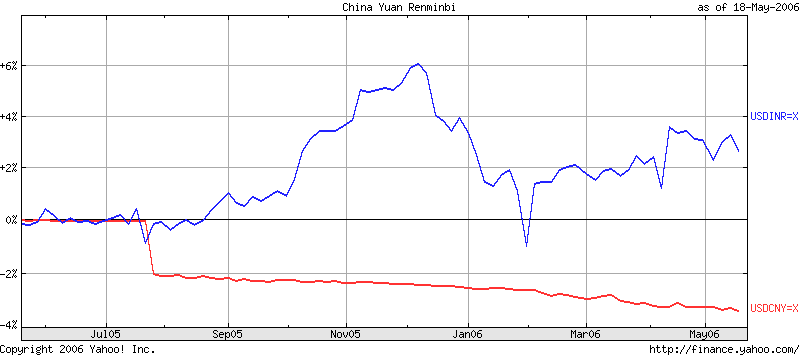

The red line is the Chinese Renminbi and the blue line is the Indian rupee, which clearly has done a bit better on volatility. I find it fascinating how, at the end of five years of all kinds of drama, they are both at the same place. The graph of the latest one year shows something more interesting:

The red line is the Chinese Renminbi and the blue line is the Indian rupee, which clearly has done a bit better on volatility. I find it fascinating how, at the end of five years of all kinds of drama, they are both at the same place. The graph of the latest one year shows something more interesting:

This tells me that over this last one year, the CNY has gained a bit and the INR has lost a bit. So Indian exports have gained ~5-6% in nominal terms. Of course, differences in inflation also matter, and the differential pace of improvement of productivity also matters.

This tells me that over this last one year, the CNY has gained a bit and the INR has lost a bit. So Indian exports have gained ~5-6% in nominal terms. Of course, differences in inflation also matter, and the differential pace of improvement of productivity also matters.

Thursday, May 18, 2006

Arguments on publicly traded exchanges

I got some fascinating responses on my previous posting on policy questions associated with publicly traded exchanges.

The comment by `Arb' (on the previous post) says:

Why this double standard? Why does every one think free markets are good for everything but the institutions in their field. Everyone from dairy farmers to financial theorists cite "unique problems" to protect their field from the free market. The listed financial products market in India is incredibly hidebound. Look at the innovation in markets like the US with the coming of players like Island, ISE etc. The NSE employes ancient technology both for its matching engine and market data dissemination. The pace of introduction of new products is glacial - why bother when there is no innovation. The BSE does not bother since management has no incentive. Look what happened to the CME and the NYSE since they have gone public. The floors are on their way out and they are aggresively laying out plans to attack other markets - bringing innovation and lower costs to investors. The various reputational issues that you outline are non-starters. Since when is it an exchange's job to track down rumours? No manager will risk the reputation of the exchange in exchange for short term profit especially when his options vests over a multi year period. The various public exchanges world wide - LSE, Deutsche Bourse - are great examples of that. In fact the Deutsche Bourse mounted a great attack on the CBOT forcing it to cut prices and innovate. We need more learning from the worldwide experience of exchanges that are private/public for-profit institution and dynamos of innovation and efficency instead of promoting the hidebound lame NSE as some paragon of the exchange model. In a race between the blind (BSE) and the one-legged (the NSE), the one-legged will win. It does not follow that the one-legged will excel in the Olympics. We need Olympians, not protection of the one-legged.

A response from He-who-won't-be-named (in email) says:

You are right about contrasting the Indian governance environment with that in UK or US. If Sanjay Kumar of Computer Associates had done in India whatever he did in USA, he would not have had to face life in prison. In our environment, it is best to avoid the kind of conflicts that would come from listing an exchange on itself. The problem is not limited to exchanges. Every broker and fund manager in the market routinely faces this conflict of interest. If I can make more money by churning my clients portfolio, there is nothing that stops me from doing it, other than the fear of having my licence cancelled. If I don't need to bother about that eventuality, then the temptation to take the easy path to earnings will be too hard to resist. If I am listed and my CFO has to give earnings guidance every quarter, it only makes it worse (imagine the CFO of a listed exchange giving guidance to a bunch of analysts). Wherever we deal with "other people's money" we need to deal with these conflicts. Lastly, even without listing, shareholders can try to milk dividends and put pressure on exchanges to increase revenues. The board of directors of an exchange have responsibilities that go far beyond those exercised by the board of a normal firm, and necessary checks and balances should be part of the structure of rules under which the board operates. Ethics and governance are a big topic. Despite all the advances of the past few years, we have only scratched the surface so far. Shifting away from the ethics, I think the neglect of small cap stocks is already a case in point on the problems with what exchanges are maximising. The contribution to turnover from these stocks is minimal for the exchanges, and that results in insufficient attention to what really needs to be done to create an effective marketplace. If it is made one of the stated objectives at the board level, and if we can identify appropriate measures to judge efforts and results, we may see more concerted efforts to tackle the problem.

I am acutely aware of the pace of innovation and competition that we see in Europe and the US amongst exchanges, and the lack of innovation / competition in India. One element of a diagnosis is the weaknesses of regulation. India is weird - the central bank bans trading of currency futures. The limitations of RBI and SEBI are surely one important hurdle leading to slow progress in India - I can tell you a million tales of innovation which got blocked by regulators. The second facet is competition. I am all for more competition. I have supported the idea of entry into India by global exchanges in the past. I believe that the more exchanges are competing in India, the better.

My concerns are about governance. I simply do not believe that a simple EPS-maximising exchange-as-listed-company works well. At the simplest, I will point out that even in settings like the US, where NYSE or CME are listed, there has been special work done in terms of separating out regulatory functions into NYSE Reg (and there is some movement towards completely taking NYSE Reg out of NYSE).

In India, FMC has little experience with financial regulation, so MCX seems to have got a free pass out of them. SEBI appears to be headed for an MCX IPO or a regional stock exchange IPO without understanding these conflicts of interest. The reason I wrote that article was to put these issues on the table for the people who make these decisions. My view is that a minimum set of strictures that SEBI, as the regulator of India's securities industry, should impose on listed-exchanges is:

- An NYSE Reg structure for separating out regulatory functions from a profit-maximising entity,

- A limit on shareholding by any one party at 5%,

- A ban on self-listing (NSE can list on BSE; BSE can list on NSE), and

- A management team that has no ownership, stock options or profit-linked bonuses.

But even if SEBI did all this, I unfortunately believe it does not get the job done. This brings us to judgment about the governance environment in a given country. A Calcutta Stock Exchange will setup a CSE-Reg, a separate non-profit ostensibly for performing regulatory functions. Do you believe that there will be a genuine separation of regulatory functions, a distinction between the maximisation of CSE as opposed to CSE-Reg? I expect CSE will setup CSE-Reg to look independent on paper but in reality it will perform the bidding of CSE. My intuition in India is that a genuine separation of CSE-Reg is not possible in India. I suspect `Arb' lives outside India (He-who-won't-be-named' lives in India).

More generally, I do not think "free markets are good for everything". I think free markets are a means to an end. They are an enormously powerful tool, but they are only a means to an end. The end is to have efficiency, productivity, and to get to $10k of per capita GDP in the shortest time. There are many, many situations where a focus on free markets works wonderfully (and I have written on these situations repeatedly). But we have to grapple with the genuine puzzles of creating market institutions that actually deliver the goods.

In the exchange context, I think the only sensible governance structure is the NSE model, where the owner is a wholesale customer of the services of the exchange, where the sound functioning of the exchange is much more important for the owner than the flow of dividends from the exchange, and the management team has no ownership in any form - whether shares, stock options or profit-linked-bonuses.

Such reasoning is not limited to exchanges. As an example, many people - including myself - believe that the private market for fund management is fundamentally broken. The Indian situation with mutual fund agents and insurance agents, and huge fees and expenses, is simply dysfunctional. People like Keith Ambachtsheer have been increasingly radicalised in thinking about this situation, to a point where today Keith says that there is a fundamental governance problem in fund management when the owner is not the investor. He advocates cooperatives or public sector structures. As an example, Vanguard (a cooperative) is a fantastic story of what you gain when you remove profit maximisation as a motive for the top management team for a fund management shop.

India's New Pension System, which I have consistently advocated for almost a decade now, is a whole bunch of intrusive interventions into the fund management market, designed to give customers low cost and to avoid the problems that come from profit-maximising pension fund managers placed in an ordinary "unfettered market". If you wanted an unfettered market for private pensions in India, you already have it - it's the pension schemes sold by insurance companies. It's a free market solution, backed by enormous government subsidies in the form of preferential tax treatment. But there isn't a worse deal for customers that can be imagined.

In short, we have a problem with Indian exchanges. We need more innovation, more competition. Half the problem is in regulation. More exchanges in a competitive landscape will only help. But we need to worry about the unique governance problems of an exchange, which is not an ordinary firm.

Wednesday, May 17, 2006

Listed exchanges pose unique problems

The question of listed exchanges (or "publicly traded exchanges") is now a live one in India. MCX seeks to do an IPO. A recent SEBI report says that regional stock exchanges should do IPOs and list on themselves. BSE could get listed, possibly on BSE.

I wrote an article in today's Business Standard titled Listed exchanges pose unique problems on this subject. I argue that exchanges are not ordinary firms, where we applaud when the firm graduates from startup to IPO. I suggest that listed exchanges pose daunting policy questions and that SEBI and MoF need to do deep thinking about whether India's interests are best served by a three-way separation between owners, managers and brokers.

I had blogged about the regional exchanges dimension earlier. I think the SEBI report on regional exchanges was wrong on notions of listing and possibly self-listing of regional exchanges.

Tuesday, May 16, 2006

What Arjun Singh needs to focus on

The two planks of education policy of Arjun Singh and the UPA government seem to be: Fan the flames of the conflict on quotas, and put more money into Sarva Shiksha Abhiyaan (SSA). In today's Indian Express, Ila Patnaik has an article questioning the consensus about SSA. I have written about education and SSA a few times : one two and three.

Ila argues that the consensus behind SSA rests on higher enrollment rates and growing literacy rates. But standardised tests show that kids seem to come into school for a meal and don't learn much. She asks why giant expenditures on SSA did not plan an evaluation by an independent agency which would conduct randomised tests. She also links up to a fascinating Centre for Civil Society working paper which compares private "unaided" schools, private "unaided" schools and public schools. Update: Ila has another article on entry barriers faced in starting a school.

Monday, May 15, 2006

SEBI report on regional stock exchanges

Just when you thought regional stock exchanges were safely dead and buried, a new SEBI committee report has brought the issue back to prominence. (The SEBI website is bad; here's the report.) It isn't a good report, by SEBI standards, but it needs to be tracked because it can be raw material for doing some damage. As usual, India excels at outstanding editorial commentary: read the edits in Business Standard, Economic Times.

One key proposition that seems to be getting a free pass is the idea that "Regional stock exchanges are good for SMEs". I think this statement is wrong. If a stock has the size, asymmetric information, equity vol, and ownership structure required to achieve significant trading, then it will do so on NSE anyway. NSE does not have a physical floor - there is no limit to the number of firms that can get listed on NSE. If a stock lacks these characteristics, then switching from NSE to (say) Delhi Stock Exchange will certainly not do the trick. If anything, NSE has the eyeballs: if an SME firm has a hope in hell of gaining the attention of investors, this is likely to happen more on NSE than on dinky exchanges.

Thus I believe that there are some interesting policy puzzles about liquidity for SME stocks, and I believe that we aren't doing enough to address these questions. But linking up the goals of RSEs with the dream of greater stock market liquidity for SMEs is just analytically incorrect.

Saturday, May 13, 2006

Individuals in currency trading

On an international landscape, speculative price discovery is dominated by `institutional investors', particularly hedge funds. India is unusual in two respects. First, we have speculative price discovery in only two areas: equity and commodity futures. In all other areas, the government is either a major market manipulator or has simply banned speculative trading.

The second unusual thing about India is that in these two markets, price discovery is dominated by individuals. Institutional participants - whether domestic or foreign - are but minor participants on the equity market and the commodity futures market. At every stage of financial innovation in India, my experience has been that individuals pick up new instruments and new trading mechanisms first, they build the liquidity, and then (much later) the institutions might join in the party. As an example, see the miniscule numbers for institutional trading with equity spot and equity derivatives trading in the most-recent Economic Survey or the most-recent NSE Derivatives Update, which shows that in March 2006, institutional investors made up a princely 7% of trading on the equity derivatives market.

The currency market is arguably the world's biggest market. It has been dominated by institutional trades on OTC markets. Basically, the big boys talk to each other. Leo Melamed tells the story of currency futures as originating from an opinion piece in a newspaper by Milton Friedman, who wanted to short the GBP but was told by the big banks that they wouldn't deal with him because he was just Milton Friedman, a mere individual and not a big OTC market participant. This thought process led to a great innovation - financial futures - which makes possible safe trading between strangers, and permits a gigantic scale of entry into speculative trading. While exchange-traded derivatives worked out very well, currency futures didn't really click all these years, until some very recent signs of growth.

In this context, I found a fascinating article in The Economist which talks about the rise of individuals in currency trading in Japan. It makes me wonder how currency trading in India will shape up, once we get out of the present control raj. Some excerpts:

... Japanese savers have sought greater risk - notably in foreign exchange. They started with foreign-currency bank deposits, then moved on to investment trusts denominated in foreign currencies. In the past year or so, they have taken a further step, by piling into high-risk, high-return margin trading of currencies. So keen have they been that collectively they have become important actors in the yen foreign-exchange market.Retail currency trading on margin was largely unmeasured until last year, when many intermediaries joined the Financial Futures Association of Japan (FFAJ), the industry watchdog. For the first time, the FFAJ, which does not allow members to solicit business, has been able to release figures on individuals' margin trading. In the three months to December, over-the-counter trading involving its members came to $280 billion. Experts believe that a new trading system called click365, run by the Tokyo Futures Exchange, and trades through non-members could bring the total near to Y40 trillion.

The size of Japan's foreign-currency market is hard to gauge, but experts put it at Y130 trillion-200 trillion, making individuals' share 20-30%. Retail investors have, in effect, acted like mini-hedge funds, using carry trades to buy American, Australian and New Zealand dollars, euros and sterling that give them yields of up to 7%, by leveraging their principal. Gaitame.com, the top foreign-currency retail intermediary, says that on some days its retail business beats its parent broker's wholesale transactions. Gaitame.com's retail accounts have grown two-and-a-half times over the past year (see chart), a trend reflected across the industry.

Analysts are used to believing that Japan's currency is moved by banks and brokers. Yet individuals are becoming more powerful. According to the FFAJ, they held a net long position in foreign currency of Y15 trillion at the end of 2005 - almost as big as Japan's current-account surplus and more than foreigners have in Japanese stocks.

Monday, May 08, 2006

Guns don't kill people; distorted wheat markets kill people

“Initially our offer was that any one who delivers 500 quintals to us will be offered a revolver, rifle or pistol licence. But we did not receive a single application. Farmers told us that they would be willing to consider the offer if the quantity was halved to 250 quintals. So we have agreed to that,” said a senior district official in Sitapur. Ironically, despite guns as a carrot, farmers are saying no deal. There is a price difference of anything between Rs 170-Rs 225 per quintal between FCI and open market prices. That works out to a loss of Rs 50,000 on 250 quintals if farmers choose to supply to FCI. “People say that as they can pick up a gun licence by spending Rs 15,000 in speed money, why should they undergo a loss of Rs 50,000 for it. So the scheme has been a damp squib,” said a leading local businessman.

Saturday, May 06, 2006

Was a rate hike required?

A few weeks ago, there was a great deal of focus on whether the RBI should have raised rates. I wrote an opinion piece in Business Standard where I argued that in response to the recent spike in CPI growth, and in response to the expected inflation of coming months, there is a need to raise rates now.

My reasoning is based on the `Taylor Principle' which suggests that monetary policy has to respond by more than one-for-one when there are changes to expected inflation. The trouble is: we don't measure inflation well, and there is no secondary market for inflation indexed bonds using which we can infer inflation expectations. So the question really turns on your views about inflation.

My view is that the CPI is the best inflation measure in India (and the WPI is worse than useless - your understanding of India goes down if you listen to the WPI). And, lacking either the models or the inflation-indexed bonds, I fall back on mere extrapolation. The acceleration of CPI is clear, and further oil-induced inflation is likely.

Of course, none of this makes much sense as long as we have a pegged exchange rate, for the RBI doesn't really run an Indian monetary policy as long as the exchange rate is pegged to the USD. I guess my point is that we need to bring a new monetary economics to bear on Indian monetary policy, instead of giving over the job to a mechanical currency peg.

How bad are Indian ports, and how badly does it matter?

Everyone in India is envious of the labour-intensive, export-oriented manufacturing exporft of China. The gap between India and China is caused by 4 problems: Small scale sector reservation, labour law, lack of GST and superior Chinese infrastructure.

I recently came across some striking data which suggests that Chinese ports are roughly as bad as ours. I wrote an opinion piece in Business Standard on these issues. On one hand, this raises questions about the port reforms in India - we haven't yet obtained low-cost ports by world standards.

But equally, this makes one question the importance of infrastructure as the explanation of why India lags China on manufacturing exports. Perhaps the other 3 problems are more important. You wouldn't start a factory with 100,000 employees with Indian-style labour law, which critically impedes the economies of scale that are attainable in India.

Good effort on combining maps with economic data

In the EPW of 22 April 2006, I wrote this book review of Social & Economic Profile of India by Peeyush Bajpai, Laveesh Bhandari and Aali Sinha. It is published by Social Science Press, 2005.

In the old days, there were the fascinating established disciplines of `regional economics' or `economic geography'. These lost ground over the decades, and well-trained contemporary economists have typically not studied these fields. The typical modern economist is highly conscious of time-series econometrics, but has only a rudimentary grasp of handling spatially organised data. In recent years, however, economic geography has come to enjoy a renaissance, through three factors.

The first is the new work by Paul Krugman and others which seeks to link up geography into the core questions of economics. For example, while classical trade theory focused on gains from trade through differences in factor endowments, contemporary trade theory is greatly concerned with geographical distance. The second factor at work is the heightened interest in spatial distributions of income and purchasing power on the part of the marketing fraternity, which has brought new kind of interest in learning about these questions as also an impetus for improving the informational foundations. The third factor at work has been the remarkable marriage of computers and maps with economic data, which has made it easy to visualise spatial data using interactive software systems which go by the fancy name of `geographical information systems' (GIS).

Bajpai, Bhandari and Sinha have come out with a volume titled `Social & Economic Profile of India'. In my knowledge, this represents a first effort at marrying computers, maps and economic data to produce an economic atlas of this fashion. So far in India, there are some strong GIS systems, and there are strong spatial databases. This book is the first time these have come together in a satisfactory fashion.

The authors must be commended for scouring the statistical system for spatial data. In some cases, the unit of observation is the state. In some cases, the unit of observation is the district. A very wide range of sources have been tapped to put together this volume. In some cases, the `standard sources' do not offer a certain kind of information, but the authors have reduced NSSO or NFHS data into summary statistics organised by location.

Every page of the volume is a map (in colour). Social Science Press has done an equally remarkable job of bringing world-class paper and printing to bear on this problem. As little as five to ten years ago, it was not possible to envision a book like this about India, but this has now become a reality.

The content of the book is organised as sections on Demography, Geography, Poverty and hunger, Health, Education, Water and sanitation, Employment, Fiscal analysis, Mass media, Safety and justice, Economic profile and Decentralisation. This is a fair depiction of what the Indian statistical system offers in the field. I was particularly impressed at the effort that the authors have taken to obtain data on issues of law and order and the judiciary, which tend to be ignored by the economics profession. Problems of law and order are increasingly shaping up as a central task of the State in addressing the poverty traps in the country, since participation in markets, investments in human and physical capital, and the equalising-differences of the price system cannot come into play until safety of life and property is assured.

I wandered through the book from end to end several times. Such such unstructured browsing is strongly recommended for the intelligent layman, and I am sure that each reader will take away different insights from this material. If there is one thing that I am struck by, it is the extent to which the stories are correlated. There is a powerful single factor called economic growth, which appears to affect a diverse array of spatially organised data.