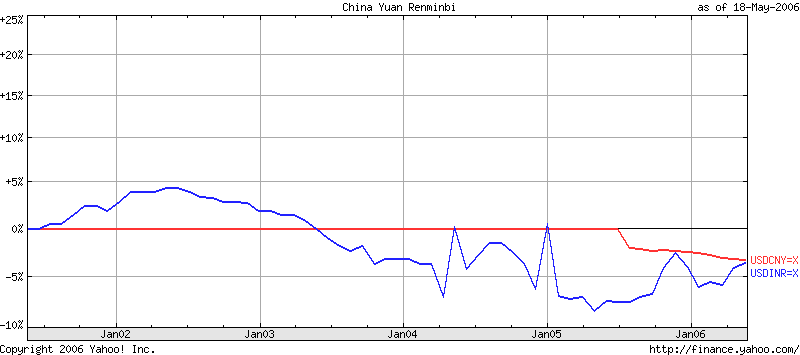

Here's a comparison of the Indian and Chinese currencies, over the last five years:

The red line is the Chinese Renminbi and the blue line is the Indian rupee, which clearly has done a bit better on volatility. I find it fascinating how, at the end of five years of all kinds of drama, they are both at the same place. The graph of the latest one year shows something more interesting:

The red line is the Chinese Renminbi and the blue line is the Indian rupee, which clearly has done a bit better on volatility. I find it fascinating how, at the end of five years of all kinds of drama, they are both at the same place. The graph of the latest one year shows something more interesting:

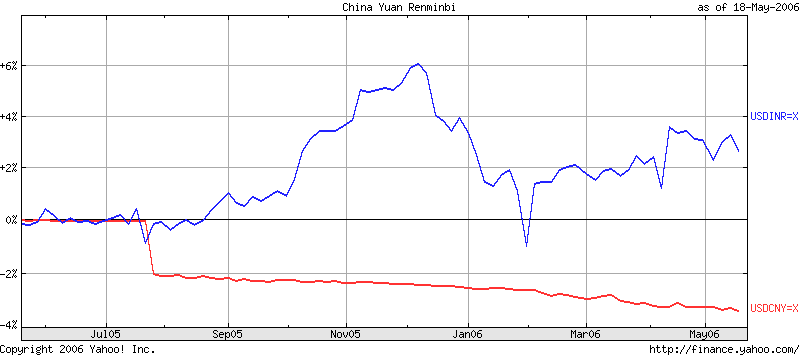

This tells me that over this last one year, the CNY has gained a bit and the INR has lost a bit. So Indian exports have gained ~5-6% in nominal terms. Of course, differences in inflation also matter, and the differential pace of improvement of productivity also matters.

This tells me that over this last one year, the CNY has gained a bit and the INR has lost a bit. So Indian exports have gained ~5-6% in nominal terms. Of course, differences in inflation also matter, and the differential pace of improvement of productivity also matters.

No comments:

Post a Comment

Please note: Comments are moderated. Only civilised conversation is permitted on this blog. Criticism is perfectly okay; uncivilised language is not. We delete any comment which is spam, has personal attacks against anyone, or uses foul language. We delete any comment which does not contribute to the intellectual discussion about the blog article in question.

LaTeX mathematics works. This means that if you want to say $10 you have to say \$10.