by

Vrinda Bhandari.

In the midst of the Bihar elections and parliamentary logjam, the fact of the President promulgating two ordinances on 23rd October to amend

the Arbitration and Conciliation Act, 1996 ("AC Act") and to enact

the Commercial Courts, Commercial Division and Commercial Appellate Division of High Courts Ordinance 2015 has largely gone unnoticed. Aimed at the speedy settlement of commercial disputes, both ordinances derive largely from the draft Bills prepared by the Law Commission of India ("LCI") in its

246th and

253rd Report respectively. Nevertheless, they have had slightly different trajectories - the Arbitration Act amendments received Cabinet clearance in August, although they were not introduced in Parliament; while the Commercial Courts Bill was pending before a Parliamentary panel, which was due to give its report on 30th November (and which is still due).

Recently,

an article by Ajay Shah offered 11 principles to improve the processes used in drafting law. In this article, I utilise this as an organising framework to critique the processes used for these two ordinances. Before starting, it is important to provide some context to the two ordinances – the principal motivation behind the AC Act was to reduce excessive judicial interference in the arbitration process, particularly in challenges to appointment of arbitrators and arbitral awards. The Supreme Court’s expansive construction of “public policy” in a challenge under s. 34 of the Act had made arbitrations as costly and time consuming as litigation. This was undermining the objective of speedy dispute resolution, whilst simultaneously introducing uncertainty for those doing business in India. Similarly, the Commercial Courts Ordinance is as an attempt to create a separate track for dealing with commercial disputes to ensure that these disputes are extracted from the otherwise stagnant civil justice system, with its low case disposal rate.

The drafting process

Let's start by describing the drafting process of the two ordinances. In case of the AC Act, the Law Ministry asked the LCI to study its proposed amendments, pursuant to its `Draft Note to the Cabinet'. The LCI constituted an expert committee comprising both Senior Counsels and junior lawyers. It also received written submissions from various lawyers (including government counsel) and organisations such as FICCI, CII and ASSOCHAM and held meetings with former judges (including the author of the previous LCI Report on the AC Act amendments).

For the Commercial Courts Ordinance, the Law Ministry referred a

2009 Bill on the subject to the LCI. Consequently, the LCI issued a "First Discussion Paper" specifying the defects in the Bill and its proposed changes and sent it to an expert committee, comprising sitting judges, Senior Counsels and junior lawyers. Based on their feedback, LCI issued a "Second Discussion Paper" and a draft Bill, which was then circulated to the Bar in Delhi, Madras and Bombay for comments. Subsequently, a small team (including policy specialists) finalised the draft Bill.

Based on these draft Bills and the internal deliberations of the Cabinet, the government issued the two ordinances, after making various changes. In this background, this post now considers compliance with the 11 principles and the impact they had on the outcome.

We now work through the 11-fold path to drafting better laws.

1. Be wary of incumbents. "Do not judge your own cause":

The first principle of good drafting is to exclude the incumbent agencies, directly affected by the law, from the drafting process. This prevents the draft law from providing more power and less accountability for the incumbent agency. To some extent this was avoided in the AC Act amendments because the LCI involved commercial organisations, lawyers and judges (with arbitration experience), each with their own vested interests. This helped balancing out incentives, and enabled the introduction of proposals for a new costs regime (adversely affecting lawyers/litigants) and incorporating the International Bar Association's Guidelines on Conflict of Interest (adversely affecting arbitrators' interests).

LCI's extensive consultation during the drafting of the Commercial Courts Bill, and the selection bias in terms of the lawyers who took time to respond, meant that new measures were also introduced against the natural incentive of lawyers/litigants to delay proceedings. Thus, s. 16 provides for amendments to the Code of Civil Procedure (“CPC”) and includes a costs regime, case management hearings, time limits etc.

2. Malleability vs. the agency problem:

Good laws achieve flexibility or “malleability” by leaving procedural details to subordinate legislation, without it empowering the incumbent agency to undermine the objectives of the principal law. This is not as much of an issue here since the current ordinances do not envisage the establishment of a separate agency.

Pertinently, however, malleability is achieved in the case of the Commercial Courts Ordinance by s. 3, which leaves the constitution of the Commercial Courts to the discretion of the State Government, to be exercised in consultation with the concerned High Court. Similarly, the Chief Justice of each High Court having ordinary original civil jurisdiction, i.e. Delhi, Bombay, Madras, Calcutta, and Himachal Pradesh, has the discretion to decide whether to constitute a Commercial Division in that High Court. The Ordinance, therefore, provides the requisite flexibility to the State Governments and the High Courts to decide if, and when, to take advantage of the Ordinance based on their specific local requirements. Thus, the Delhi High Court is the first Court to notify the constitution of Commercial Divisions and Commercial Appellate Divisions as per the Ordinance.

3. The Joint Secretary cannot manage these projects:

It is easier for a dedicated team, as opposed to a Joint Secretary, to put in the time and effort required to draft a new law. As discussed, the process of drafting these two ordinances was substantially different, inasmuch as it involved the LCI's team and not senior government officials. To that extent, these ordinances are a much-needed improvement from status quo.

However, using LCI drafts’ as the basis for ordinances is not a permanent organisational solution, since that makes it contingent on the composition of the LCI, which changes every three years. Interestingly, the 20th LCI, chaired by Justice A.P. Shah was unique in its involvement of external consultants, lawyers, academics and policy specialists and introduced the norm of drafting Bills instead of just giving suggestions to the government.

Moreover, the overall practice of promulgating ordinances should proceed with caution. Ordinances involve no pre-legislative public consultation or parliamentary debate, which help remedy the (inevitable) problems with drafting. Any subsequent change, when the ordinance is finally approved by Parliament, can create further uncertainty in the interpretation of law in the intervening period.

4. Writing law is different from reading it:

The process of

writing good laws requires combining specialist knowledge with public administration skills. The current ordinances have been primarily drafted by lawyers with domain knowledge, but no skills in public administration. The modifications to the LCI draft were, however, made by the Law Secretaries/Ministry officials. However, in both cases, the LCI had drafts to work with -- the existing AC Act and the 2009 Commercial Courts Bill. So the LCI did not have to start from scratch. Further, the laws itself were relatively simpler, and thus easier to draft than the two big recent laws, the

Indian Financial Code and the

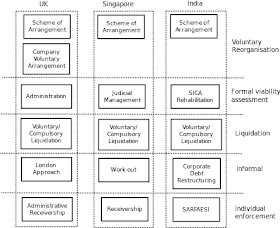

Insolvency and Bankruptcy Bill, 2015.

5. No premature coding:

Ajay talks about the importance of the ‘thinking process’ as a necessary preamble to drafting reasoned and well-written laws to prevent `repentance in leisure'. The LCI followed a substantive `thinking process’ with the Arbitration and Commercial Courts Reports taking nearly four and two years respectively, at least on paper. Both draft Bills were supported by a comprehensive report that explained the rationale for the proposed amendments and the reasons for disagreeing with previous suggestions. Further, as explained above, each report was preceded by interim consultation papers, which helped capitalise on specialist domain knowledge. These processes illustrate that there was no premature coding, at least at the LCI’s end.

6. Access control in the drafting or editing process:

The absence of premature coding has to be accompanied with giving control of the editing process only to a small team, steeped in the drafting process. This was completely absent in the present case, since LCI's draft Bills (prepared by a small team after extensive deliberation) were edited/modified by an entirely different team at the government secretariat. In fact, the first draft of the Arbitration Ordinance

was never sent to the President for assent, after serious objections were raised to some of its clauses, including a mandatory time limit of 9 months for an arbitrator to decide arbitrations. Consequently, the government consulted Justice Shah and other jurists. Nevertheless, they were not consulted on the second and final draft of the Ordinance. In addition, the original LCI drafting team never saw the changes made by the government, since they were not available to the public, and had no inputs. This has resulted in problems.

For instance, s. 29A introduced by the Arbitration Ordinance fixes a time limit of 12 months (18 months by consent) to make an arbitral award, after which the arbitrator's mandate shall terminate, unless the Court extends the period. This one-size-fits-all approach ignores the possible complexity, volume of material and multitude of parties/contracts before the arbitrator. It marks a return to the pre-1996 stand of increased judicial involvement and even incentivises respondents to delay proceedings.

Conversely, s. 29A(2)'s provision giving additional fees to arbitrators for making the award within 6 months prioritises speed over quality, which is equally dangerous because the grounds for judicial interference to set aside awards are very narrow.

Further, the Arbitration Ordinance omitted the LCI's recommendation to provide for emergency arbitrators in s. 2(d), in line with SIAC Rules and international practice.

[1] Further, while accepting the LCI's recommendations to require the disposal of a s. 34 objection petition to a domestic award within one year, the Ordinance ignored similar recommendations for a one-year disposal limit to s. 48's conditions for enforcement of foreign awards. Such significant errors may not have crept up if the same team had drafted and edited the law.

7. The need for continuity and absorption:

The above examples illustrate the drawbacks of not having a continuity of personnel drafting and editing a single law. Good drafting requires continuity so that the team can understand the impact of changes in one section on another section. The advantage of continuity is seen with the speed with which the LCI drafted a

Supplementary to Report No. 246 to undo the Supreme Court's wide construction of "fundamental policy" in

ONGC v Western Geco, one month after the decision. This amendment was incorporated as an Explanation to ss. 34(2)(b) and 48(2)(b) of the AC Act, displaying the advantages of absorption.

However, to add to Ajay’s principle, it is also important to retain continuity amongst those drafting different laws within the same field. The

Delhi High Court (Amendment) Act, 2015, which was passed and notified on

26.10.2015, increased the pecuniary jurisdiction of the High Court from Rs. 20 lakhs to Rs. 2 crore. Merely a month later, the Commercial Courts Ordinance, with its wide definition of 'commercial dispute' was notified in Delhi on

17.11.2015. The cumulative effect of both the Amendment and the Ordinance is that the High Court has jurisdiction over all commercial matters over Rs. 1 crore, while all civil disputes valued less than Rs. 2 crore have been shifted to the trial courts in Delhi. The LCI in its 253

rd Report recommended setting the pecuniary jurisdiction of the Delhi High Court at Rs. 1 crore to prevent such an anomaly. Now, disputes valued between Rs. 1-2 crore will be decided by the trial courts, even though disputes above Rs. 1 crore have been benchmarked as being likely to involve technical issues requiring specialist judges or benches.

The notification of the Amendment and the Ordinance almost simultaneously can be seen either as a means of appeasing the influential High Court lobby (to retain business for the High Court lawyers) or a case of one hand of the government not knowing what the other is doing. In either case, a harmonious interaction between the laws could have been achieved by fixing the pecuniary limit at Rs. 1 crore.

8. Break with our traditional writing style:

Most of our laws introduce uncertainty because they are unnecessarily complex. They are not simple to read and are not to the point. The two ordinances seem better drafted, with the Commercial Courts Ordinance incorporating the LCI's illustration in s. 35 CPC on imposing costs on decree-holders. However, there is still a long way to go till we adopt the British system of drafting simple laws with illustrations, e.g. the IPC in India.

9. Gear up for a detailed law:

Good laws are not simple high-level statements and have sufficient detail to account for different circumstances. Both the current ordinances follow this principle and are detailed codes.

For instance, the Commercial Courts Ordinance has introduced comprehensive amendments to the CPC to deal with the award of costs. These specify what constitutes costs; the circumstances to be considered while awarding costs; and the range of orders that can be made by Courts under the provision. Similarly, the Arbitration Ordinance introduced the Fifth Schedule detailing different circumstances that give rise to justifiable doubts about the independence or impartiality of the arbitrator, with the Sixth Schedule containing the form of the arbitrator’s disclosure. The newly introduced Seventh Schedule lists the categories of relationships between the proposed arbitrator and the parties/counsel/subject matter that would make the person ineligible to be appointed as arbitrator.

10. Given enough eyeballs, all bugs are shallow:

Good drafting requires an elaborate process of peer review and public consultation to identify flaws beforehand. While the Bills prepared by the LCI were peer-reviewed, the current ordinances were not open for public comment or expert review. This is especially problematic in the case of the Commercial Courts Ordinance, which was promulgated even while the Bill was pending with the Parliamentary Standing Committee on Law and Personnel till 30.11.2015. Considering the history of the Bill in 2009, the importance of the Select Committee's input, and the eventual withdrawal in face of Rajya Sabha opposition, the government should have tried passing the law through Parliament rather than taking the ordinance route. Any amendment now will create even more confusion about the law's applicability.

11. Code re-use - but in the future:

Good drafting requires starting with `clean building blocks’ rather than replicating the existing defective landscape. These new laws can then provide opportunities for reuse in the future. The 253

rd Report rejected the 2009 Draft Bill’s core proposal of vesting original jurisdiction in Commercial Divisions in High Courts and transferring all such disputes to the High Court. It considered the proposal problematic. Instead, it introduced the idea of separate Commercial Courts at the district level and Commercial Division and Commercial Appellate Division of High Courts. This was incorporated in the Commercial Courts Ordinance.

The Ordinance also introduces novel `building blocks', from the insertion of a new Order XV-A, CPC laying out a complete code for case management hearings; to the requirements under s. 17 for the Court to collect and disclose statistical data; and training and continuous education stipulation under s. 20. These can hopefully act as opportunities for code reuse in the future, especially for the eventual amendment to the CPC.

Conclusion

While the process followed in drafting the Arbitration and Commercial Courts Ordinances is a big improvement on the prevailing drafting process, the process was not ideal. As has been shown, drafting changes made by the government to LCI's draft without stating any clear rationale has created legal issues in both the ordinances. Legal drafting is a technical skill which the government as of now lacks. Policy makers should seriously think about how to improve State capacity in this regard.

As stated above, the Ordinances were urgently required to remedy the problems of costly and time-consuming commercial dispute resolution in India. While they suffer from various drafting flaws, in comparison with the

status quo they undoubtedly represent an improvement of the litigation landscape here. For instance, the amendments made in the AC Act have reduced the scope of judicial interference in the arbitration process. Similarly, the Commercial Courts Ordinance has ensured that the ordinary processes of the CPC no longer apply and has simultaneously introduced novel principles of case management. Thus, improved processes have resulted in improved outcomes in this case. In turn, it is hoped that these Ordinances will reduce the transaction cost of doing business in India by resolving disputes expeditiously, fairly and in a cost-effective manner. If the 11 steps towards better drafting had been properly applied, the results would have been even better, and would have helped design more effective laws.

Disclosure and acknowledgement

The author was involved in drafting the 253rd LCI Report.

The author thanks Pratik Datta for useful discussions.

Footnotes

[1] The LCI proposed to amend s. 2(d) defining "arbitral tribunal" to means a sole arbitrator or a panel of arbitrators "and, in the case of an arbitration conducted under the rules of an institution providing for appointment of an emergency arbitrator, includes such emergency arbitrator". Its appended Note reads, "NOTE: This amendment is to ensure that institutional rules such as the SIAC Arbitration Rules which provide for an emergency arbitrator are given statutory recognition in India."

Vrinda Bhandari is a practicing advocate in Delhi. She was involved in the Law Commission of India's 253rd Report on Commercial Courts.