Recent moves in Indian bankruptcy reform have come about as a response to a broken system that has been termed `capitalism without exit'. Table 1 shows estimates on Resolving Insolvency parameters from the World Bank's `Doing business' database in 2015.

| Indicator | India | South Asia | OECD |

|---|---|---|---|

| Time (years) | 4.3 | 2.6 | 1.7 |

| Cost (% of estate) | 9.0 | 10.1 | 8.8 |

| Recovery rate (%) | 25.7 | 36.2 | 71.9 |

| Outcome (0=piecemeal sale; 1=going concern) | 0 | 0 | 1 |

| Strength of insolvency framework index (0-16) | 6 | 5.6 | 12.2 |

| Domestic financial credit to GDP (%) | 74.8 | 69.5 | 210.8 |

A comparative law perspective

In a recent paper (Sengupta and Sharma, 2015) we study the corporate insolvency resolution frameworks of the UK and Singapore, compare these with the existing framework in India and draw lessons for Indian bankruptcy reform. This paper was part of the research process that led up to the report of the Bankruptcy Law Reforms Committee (BLRC).

The UK, Singapore and India are all ostensibly common law jurisdictions. However, bankruptcy law has evolved in different ways in each of the three countries, and the outcomes are very divergent. On the Resolving Insolvency indicator of the World Bank's `Doing Business' Report, 2015, the UK ranks at 13, Singapore ranks at 27, and India has a rank of 136.

The size and structure of their credit markets (Table 2) are also very diverse. The Indian credit market is relatively small and bank-dominated. The UK and Singapore have larger credit markets, and bigger bond markets.

| Indicator | UK | Singapore | India |

|---|---|---|---|

| Rank | 13 | 27 | 136 |

| Time (years) | 1.0 | 0.8 | 4.3 |

| Cost (% of estate) | 6.0 | 3.0 | 9.0 |

| Outcome (0=piecemeal sale; 1=going concern) | 1 | 1 | 0 |

| Recovery rate (%) | 88.6 | 89.7 | 25.7 |

| Domestic financial credit to GDP (%) | 171.5 | 126.3 | 74.8 |

| Bank credit to GDP (%) | 85.3 | 56.5 | 93.1 |

Each country is at a different stage of building its corporate insolvency framework. The UK started out with a reasonably sensible common law system, and has undertaken two rounds of significant reform, in 1986 and in 2002. The Insolvency Law Reform Committee (ILRC) of Singapore, set up in 2010, submitted its recommendations in 2013. India began on this journey in 2014, with the establishment of BLRC by the Ministry of Finance.

Institutional mechanisms

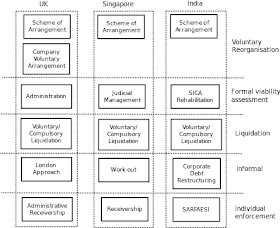

Figure 1 above shows the corporate insolvency procedures of the three countries. In the UK and in Singapore, the formal procedures are contained in a single law (except Scheme of Arrangement in the UK which is contained in the Companies Act), whereas in India they are fragmented across many laws.

Till 1985, in the UK, corporate insolvency was placed in the Companies Act. In 1986, the UK enacted the Insolvency Act, a comprehensive law dealing with insolvency of companies and individuals. In Singapore, the Companies Act is the primary corporate insolvency law, and contains procedures for reorganisation and liquidation.

In India, the Companies Act 1956 and 2013, has (deficient) provisions for liquidation. Reorganisation is available only to certain types of industrial companies, through the Sick Industrial Companies Act (SICA 1985).

In addition, the UK and Singapore laws deal with interaction of the insolvency law with other laws of the land through a combination of judicial interpretation and legislative carve-outs. This appears to work well for them, as they are ultimately getting good outcomes. In India, the interaction between laws is fraught with complexity and this, combined with judicial capacity constraints, has been one of the causes for delays in resolution (Ravi, 2015).

Lesson 1: We require a single, consolidated law with well defined interaction with other laws.

Institutional setting: courts

The judiciary is an integral part of the insolvency resolution process. In the UK and in Singapore, a single adjudicating authority presides over insolvency proceedings. The Chancery Division of the High Court in the UK hears corporate insolvency matters. In Singapore, the High Court, equipped with adequate capacity, exercises significant discretion in dealing with insolvency proceedings.

In India, multiple adjudicating forums deal with liquidation and reorganisation matters. High Courts hear liquidation cases under the Companies Act, while the Board for Financial and Industrial Reconstruction (BIFR) hears reorganisation cases under SICA. High courts are often found reviewing BIFR decisions afresh, causing further delays in proceedings (Ravi, 2015).

Courts in India are challenged by serious capacity constraints. This is reflected in their high levels of pendency. The average pendency of BIFR cases is 4.5 years. Anecdotal evidence suggests that pendency of liquidation cases in High Courts is 9-10 years. Considerable new work is required in order to make courts work (Datta and Shah, 2015).

Lesson 2: We require a single adjudicating authority with adequate capacity to ensure timeliness in adjudication.

Lesson 3: We need to precisely define the role of the adjudicating authority and build capacity at courts commensurate with their role in the process.

Institutional setting: insolvency professionals

Insolvency professionals ("IPs") play a central role in insolvency proceedings. The UK has a private, competitive industry of IPs regulated by the government. Multiple self regulating organisations (SROs) monitor and enforce standards for licensing and practice. These SROs are, in turn, regulated by an executive body of the Ministry of Business, Innovation and Skills.

In Singapore, the Insolvency and Public Trustees Office of the Ministry of Law empanels and regulates a private industry of IPs. The Companies Act defines the qualifications required for becoming an IP.

In India, a public financial institution or a scheduled bank acts as an Operating Agency (OA) in reorgnisation cases under SICA. Official Liquidators (OL) are appointed by the central government and attached to each High Court. The provisions for appointment of OLs are in the Companies Act. Both OAs and OLs face capacity challenges. Their roles and incentives in the insolvency resolution process have been heavily criticised (Eradi, 2000).

Lesson 4: We require a private competitive industry of insolvency professionals.

Lesson 5: We require strong oversight regulation to enforce minimum standards of professional and ethical conduct, and to formulate correct incentives for insolvency professionals.

Comparison of procedures: Reorganisation

Administration in the UK, Judicial Management in Singapore and BIFR filings in India are the formal reorganisation procedures. The main procedural differences across the three countries are:

- In the UK and in Singapore, th reorganisation procedure can be initiated by both debtor and creditors. In India, the primary onus for initiating the procedure lies with the debtor. Creditors have low power when faced with default. The metaphor employed in India is that of a sick patient who seeks out medical care on his own.

- In the UK, the process can be triggered on the basis of actual or impending insolvency. In Singapore, evidence of inability to pay debts is required. In both countries, early signs of financial distress can cause the debtor to trigger. In India, erosion of balance sheet networth is required as a trigger for the reorganisation procedure. This disincentivises early triggering by debtors.

- Both in the UK and in Singapore, the existing management loses control of the company upon trigger. A moratorium on creditor actions and legal suits is enforced for a defined period of time. In India, the existing management retains control during the reorganisation process. They may have greater information, but their objectives may not be aligned with the creditors.

- Both in the UK and in Singapore, a committee of creditors vote on the reorganisation plan. In India, the BIFR adjudges and approves the plan. Creditors' rights are weak throughout the insolvency proceedings.

- In the UK, the Administrator is generally appointed by the debtor with consent of creditors. In Singapore, a Judicial Manager is appointed by the court and is monitored by a committee of creditors. In India, the OA under SICA is appointed by and acts under directions of the court. Creditors have no say in matters concerning OAs.

- The court's role is the least in the UK. The court there mainly acts as a body for dispute resolution and providing guidance to the Administrator. The court in Singapore plays a more active role in the resolution process. In India, BIFR as a subordinate of the High Court plays a critical role in deciding on the rehabilitation plan.

Lesson 7: We need to ensure that assessmement of viability of a company is done by concerned parties. Courts should merely aid but not adjudicate upon this decision.

Lesson 8: We require a design that would set the correct ex ante incentives for all parties. For example: penalty for fraudulent or frivolous triggers, loss of control by existing management in exchange for a moratorium, and safeguards against abuse of process by debtor, creditors and IP.

Comparison of procedures: Liquidation

In the UK, Singapore and India, liquidation precedes winding up of a company. In the UK, winding up is a remedy available under the Insolvency Act, 1986. In Singapore and in India, it is available under their respective Companies Acts.

The three countries follow similar liquidation procedures. Both creditors and the debtor can trigger liquidation which can be voluntary or court ordered. In the UK and in Singapore, creditors nominate the liquidator, and the court usually accedes to this nomination. In India, an OL is appointed by the High court for liquidation proceedings.

The major difference lies in the time taken for liquidation proceedings to be completed. In both the UK and Singapore, liquidation proceeding may get completed within 1-2 years. In India, liquidation proceedings continue for 9-10 years on an average, and up to 25 years in some cases.

Liquidation should act as a credible threat that keeps the debtor and creditors on the negotiation table during insolvency procedings. Delays of the type witnessed in India reduce confidence in the formal resolution framework.

In addition, secured creditors need to know that they will receive priority in liquidation payments to the extent of their security. The rights of unsecured creditors need to be protected as well, to promote diverse credit sources in the economy. In the UK for example, the Crown gave up its priority on tax dues in exchange for a defined amount of payment to unsecured creditors. A well defined priority of distribution of liquidation proceeds is also needed to provide all creditors with the ability to estimate their loss-given-default.

In India, secured creditors prefer to use individual enforcement under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI 2002) over the formal framework for insolvency resolution. This is because in the latter, their rights are pari passu with workers. This creates a bias against selling a firm as a going concern, and thus reduces the recovery rate.

Lesson 9: We require timely and effective liquidation.

Lesson 10: We require a well defined priority of distribution of liquidation proceeds. This sets ex ante incentives for development of credit markets as well as for use of the formal resolution framework by various classes of creditors.

Conclusion

An analysis of laws and procedures of the three countries yields important lessons for corporate bankruptcy reform in India. These have been incorporated in the BLRC Report:

- A single, consolidated Code.

- A single adjudicating authority supported by a court administrative unit.

- A regulated but private and competitive industry of insolvency professionals.

- A collective, time bound process to assess viability of the company.

- Assessment of viability during a calm period by concerned parties.

- Moratorium on claims, balanced by transfer of control of the company from debtor to IP.

- Creditors' rights to trigger insolvency proceedings and vote on a resolution plan.

- A timely liquidation process and well defined waterfall of priorities.

Enacting a draft bill containing these provisions is only part of the reform process. Effective insolvency resolution will depend to a large extent on the manner in which these provisions are implemented and the enabling infrastructure is set up. What works in Singapore and the UK is not just the de jure status, but the State capacity in the institutional machinery through which the law is enforced. In absence of a proper implementation plan, the entire reform process may become an exercise in 'isomorphic mimicry'.

References

Eradi, V. B. (2000),"Report of the Committee on Law relating to Insolvency of Companies".

Datta, Pratik and Shah, Ajay, How to make courts work?, Ajay Shah's blog, 22 February 2015.

Ravi, Aparna (2015), "Indian Insolvency Regime in Practice: An Analysis of Insolvency and Debt Recovery Proceedings", Economic and Political Weekly, Volume 1, No. 51.

Sengupta, Rajeswari and Sharma, Anjali (2015), "Corporate insolvency resolution in India: Lessons from a cross-country comparison", IGIDR Working Paper 2015-29, December.

The authors are researchers at the Indira Gandhi Institute for Development Research, Bombay.

No comments:

Post a Comment

Please note: Comments are moderated. Only civilised conversation is permitted on this blog. Criticism is perfectly okay; uncivilised language is not. We delete any comment which is spam, has personal attacks against anyone, or uses foul language. We delete any comment which does not contribute to the intellectual discussion about the blog article in question.

LaTeX mathematics works. This means that if you want to say $10 you have to say \$10.