- The talent pool in Macro and Finance, 25 August 2013.

- A tale of two economies and two currencies, 1 July 2012.

- Guide to the Eurozone crisis, 17 November 2011

- Mumbai as an international financial centre, 1 February 2010

- Responding to the global crisis, 8 March 2009

- The image of India: Terrorised and tarnished, 24 December 2008

- Brown and TARP: Are they perpetuating the mess we're in?, 25 November 2008

- Does anyone have a post-recession exit strategy, 27 November 2008.

- `Ideas exchange' with Percy Mistry in IE & FE, 21 September 2008

- Global Turbulence: Its Unfolding Trajectory and the Likely Implications for India, 26 August 2008.

- Paying the price of ignorance, 17 May 2008

- Fouling up finance: Same old questions, same wrong answers, 31 March 2008

- Financial innovation and financial sector reform, 27 March 2008

- Pitfalls of the Indian middle path, 27 February 2008

- The Mumbai-IFC report: of Discourse, Garlands and Brickbats!, 9 August 2007

- Mumbai as an international financial centre, 2 April 2007

Saturday, June 30, 2012

Author: Percy Mistry

Tuesday, June 26, 2012

Highways: from good to great

Mark Thoma's blog just led me to fascinating pictures from Kenya about elephant-friendly underpasses. This will reduce destructive human-animal interactions, and improve gene flow.

In Canada recently, I saw some remarkable construction work on the big highways. They have huge overpasses which are then forested over, to permit the animals to cross from one side to another. Here is the Google satellite imagery:

The scale on the left suggests that the overpass is roughly 50m wide, which is quite a bit. It is wide enough for grizzly bears and elk to cross without necessarily having unpleasant encounters with each other. The photograph also shows trees growing on the overpass. Here is what it looks like while on the road:

I had never imagined something of this scale before, but there appears to be a flourishing effort worldwide of this nature. Also see Home on the range: A corridor for wildlife by Cornelia Dean in the New York Times from 23 May 2006.

I rode by train through Rajaji National Park recently, and the train went very slow and made noise constantly, in an attempt to avoid killing elephants. The initiatives at reducing collisions between trains and elephants in that region appear to be working. In 2012, I read a story by Nidhi Sharma in the Economic Times about NHAI building 13 underpasses for animals over a 9 kilometer stretch on NH-7 through Pench Tiger Reserve. This is an important dimension to the fresh focus on road safety that needs to be a part of the large scale building of new roads that is now taking place in India.

Sunday, June 24, 2012

Why is solving India's inflation crisis important?

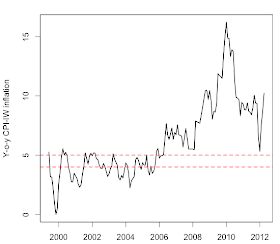

All of us are aware of India's inflation crisis. It is very disappointing, how we lost our grip on stable 4-to-5 per cent inflation which was prevailing earlier. From February 2006 onwards, in every single month, the y-o-y CPI-IW inflation has exceeded the upper bound of 5 per cent.

All of us agree that there is something insiduous when 10% inflation effectively steals 10% of the value of my wallet or fixed income investments. In India, however, we often hear the argument "Yes, this is bad, but if high inflation is the way to get to high GDP growth, let's get on with it". It is, then, important to ask: Why is low inflation valuable?

Nominal contracting is very important

Complex organisation of economic life involves myriad written and unwritten contracts involving households and firms. The vast majority of these contracts are written in nominal terms, i.e. in rupee values that are not adjusted for inflation.

Every society needs to adjust all the time, in response to changes in tastes and technology. When tastes or technology change, the structure of production needs to change, which involves renegotiation of (written or unwritten) contracts. These adjustments are costly. Contracting is costly, and renegotiating contracts is costly.

It is useful to think of a finite supply of adjustment as being available in the country. We should devote that full power of adjustment to the beneficial adjustments associated with changes in tastes and technology. In a place like India, where GDP doubles every decade, the requirement for adjustment is (in any case) large.

Inflation is an acid that corrodes all nominal contracts. Two people may have agreed on a contract two years ago at Rs.100, but that contract is thrown out of whack because of 10% inflation per annum. That contract has to be renegotiated. Bigger values of inflation corrode personal relationships also, given that there are many financial ties within friends and family.

Contracting is costly. Almost everything that senior managers do is to arrive at complex deals that create and sustain complex structures of production. This work is continually torn down by high inflation which makes the deals of last year break down today. Managers are able to build sophisticated edifices of contractual arrangements under low and stable inflation. These webs of contracting are harder to build and hold up when the acid rain of inflation is continually tearing these down.

Inflation messes up information processing

To continue on the theme of adjustment, the essence of a market economy is adjustments to relative prices, reflecting changes in tastes and technology. Firms learn about the viability of alternative investments by watching relative prices change. Inflation messes up this information processing. It increases the `background noise' by making a large number of prices change at once. This makes it harder to discern which price change is fundamentally driven, and merits a response in terms of increased or decreased production.

Building a sophisticated market economy is all about making long-term plans. When a firm decides to build an airport or a highway, this involves making NPVs over the next 20-40 years. This requires having a fair idea about future inflation. If inflation will fluctuate in the future, then firms will err on the side of caution when making plans about the future, i.e. investment will be reduced. I will stress that long-term investment, in projects such as infrastructure or heavy industry, relies critically not just on a long-term bond market (which, in turn, critically requires low and stable inflation) but also on the calculations happening in a spreadsheet about the NPV of the investment project, which involves projecting all revenues and all expenses for the next 20-40 years (which also critically requires low and stable inflation).

Impact upon pre-existing nominal savings

For a person at age 60 who expects to live to age 85 or 95, fixed income investments are absolutely crucial in the financial planning of these 25-35 years. These calculations can be destroyed by a short bout of inflation.

A civilised society is one in which people can make plans for the deep future, and trust in financial instruments. It is simply cruel on the elderly to inflate away their nominal assets. The possibility of even one bout of high inflation over the coming 25-35 years forces people to drop back to other mechanisms of protecting themselves in old age. What is needed is not just inflation control right now. What is needed is the environment of mature market economies, where outbursts of inflation are fully ruled out for decades to come.

Impact upon relationship with banks

In India, banks pay very low interest rates. While many interest rates have been deregulated, the interest rates paid by banks are held back by factors such as low competition and financial repression (i.e. forced purchases of government bonds).

When households expect inflation will be 12%, they will see a 4% interest rate paid by the bank as yielding -8%. This has many consequences. On one hand, households and firms expend excessive (wasteful) effort on minimising their holdings of low-yield cash. In addition, households tend to shift away from fixed income contracting with the formal financial system. Both these distortions are caused by inflation, and exacerbated by flaws in the financial system.

If the financial system were regulated sensibly, then with high inflation we would immediately get higher nominal interest rates since buyers of 90 day treasury bills would demand higher interest rates to pay for inflation. This would reduce the damage caused by high inflation. In India, we suffer from bigger negative effects because of a faulty financial system.

These may seem to be small things but they actually are fairly large effects. Towards an understanding of the costs of inflation -- II, by Stan Fischer, 1981, argues that perfectly anticipated 10% inflation induces a cost of 0.3% of GDP on account of only one factor : excessive efforts by households and firms to hold less cash.

The rising prominence of gold

Gold is a barbarous relic; it is the investment strategy of choice for uneducated people. It is also a vote of no confidence in fiat money. Our failures in creating a capable central bank, which delivers sound fiat money, are taking Indian households back to their old ways. Many decades of progress in getting households to engage with the modern financial system is being undone in this inflation crisis.

A classic quotation

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become `profiteers', who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and it does it in a manner which not one man in a million is able to diagnose.

From Chapter 6 of The Economic Consequences of the Peace, by John Maynard Keynes. Source: Who said ``Debauch the Currency'': Keynes or Lenin? by Michael V. White and Kurt Schuler, Journal of Economic Perspectives, Spring 2009.

But is there not a tradeoff between growth and inflation?

For a brief period, the empirical evidence in the US suggested that there was a tradeoff between inflation and unemployment. Here's the classic picture, for the 1960s in the US:

which shows a nice relationship where higher inflation has gone with lower unemployment. This evidence has led many people, particularly those concerned with the plight of the unemployed, to advocate higher inflation.

A look at the same evidence for the US, over a longer time period, shows no such tradeoff:

The idea that there is a tradeoff between inflation and unemployment is thus an artifact found in the minds of people who studied economics in the 1970s. This proposition was pretty much dead by the late 1970s. One by one, as central banks moved to inflation targeting, aiming and delivering 2% inflation, unemployment went down, not up. Hawkish central banks are the central story about how the stagflation of the 1970s was broken.

In the empirical literature, it is quite clear that by the time we get to double digit inflation, this has a discernable and negative impact on growth. This generally means that at a 95 per cent level of significance, you can reject the null of no effect, in conventional datasets. The conceptual reasoning above gives no reason for believing that there should be a threshold effect, that inflation above 10% should hurt growth but below 10% things should be fine. It could well be the case that when you get to smaller values for inflation (e.g. 9%) this effect size is not detected with conventional datasets at the 95 per cent level of significance.

It is interesting to look at the target inflation rate set in the numerous countries which have setup either de facto or de jure inflation targeting. The median value chosen has been: 2%. If people were convinced that inflation below 10% is not damaging to growth, inflation targets may have been higher. But instead, the typical inflation target in the world is 2%. This underlines the universal consensus in favour of targeting low inflation -- more like 2% and far below the 10% that we've got stuck with in India.

In the West, some people with a weak grip of economics, and strong sympathy for the unemployed, have argued that high inflation is a good thing because it helps reduce unemployment. In contrast, in India, economists have consistently found that the poor are adversely affected by inflation. There has not been a left-of-centre lobby that is soft on inflation, here.

Conclusion

There is no tradeoff between inflation and growth.

High inflation damages growth.

One element of India's growth crisis is India's inflation crisis.

It is important to think carefully about the accountability of the central bank. RBI is not in charge of India's welfare. RBI is in charge of India's fiat money. The one thing that RBI should be held accountable for is delivering low and stable inflation, i.e. for holding CPI-IW inflation within the 4 to 5 per cent range.

Low and stable inflation is an essential ingredient of the foundations of high economic growth in India. RBI can lay that platform. They can do no more. If they try to reach into other objectives, they damage this core.

Wednesday, June 20, 2012

How to achieve safety in payments

The technological opportunity in payments

In the old days, the field of payments was inextricably interlinked with banking. Money was only held in bank accounts; the only way to move money around was through banks.

Advances in computer technology coupled with financial innovation have changed all this. Banks are no longer the only game in town for the business of holding money. An array of innovators are now in the payments game. A few interesting examples are:

- Paypal is a pure-play Internet company, which rides on top of bank accounts, and gives users a payments solution.

- Western Union moves money from person to person across the globe without referencing a bank.

- M-pesa, in Kenya, does payments over mobile phones. Money is fed into a phone as with topping up a pre-paid card. Money is then transferred to another person using an SMS.

As Merton Miller said, banking is a disaster-prone 19th century industry. If a critical function like payments can be increasingly decoupled from banking, it would make the world safer.

There are two distinct problems in payments. The first is the systemically important payment system which is the core utility of the currency. In India, it is the RTGS. This is an entirely separate issue. The present discussion is about the second component of the field of payments: the non-systemically important payments systems which are used by households and firms. This is an ordinary financial technology business.

The problem

When person X wishes to transfer Rs.100 to person Y, if the banking channel is used, the steps are as follows:

- Person X lends this money to the bank by putting it into a deposit account.

- He instructs the bank to send this to person Y.

- At the other end, it shows up as a demandable loan from person Y to the bank.

In the old world, it was not possible to enjoy the benefits of payments without suffering the credit risk of a bank. One solution that was mooted was for payments to get done in central bank funds. You can do this for a few special situations like the securities clearing corporation, but probably not for most other situations.

The same problem arises with a mobile phone company:

- When you feed money, by topping up a pre-paid account, this goes into the balance sheet of the mobile phone company.

- Now you have to hope that when the time comes for you to spend this money, the mobile phone company is still solvent.

- Mobile phone companies cannot do payments; payments is the exclusive preserve of banks. (This is the state of affairs in India).

- Mobile phone companies must become limited purpose banks.

- Mobile phone companies must come under full banking regulation.

An alternative solution: Segregation of client funds

A remarkably clean solution has been invented in the field of asset management: Segregation of client funds.

Consider a money manager such as an asset management company (AMC). At a legal level, the AMC is a mere advisor. Client money never goes onto the AMC balance sheet. Customer money sits completely separate. If the AMC goes bust, this has zero implications for clients. In the entire history of such arrangements, there has been only one episode (MF Global) where segregation of client funds did not work, in protecting customer moneys. This is in contrast with the history of banking, where failures have been taking place across the centuries, across all countries, with a high frequency.

Under such an arrangement, client funds would always sit separately, segregated from the balance sheet of the payments provider.

Segregation of client funds requires a corresponding supervisory capacity - and MF Global shows us that this supervision can possibly fail. But it would involve a much lower failure rate when compared with the problems of banking.

Implication 1: Mobile phone company as payments provider

Suppose Vodafone is my mobile phone company. When I supply Rs.1000 into my mobile wallet, this would go sit separately in a customer trust. This would not go into the balance sheet of Vodafone. If Vodafone were to go bust, this money would be returned to me. This solves the problem of the credit risk of the payments provider.

If we could do this, it would open up an array of payments innovations. The only regulatory burden placed upon the provider would be: Never ever keep customer money on your own balance sheet. We would then need some small resolution capability to kick in when the payments firm goes bust, to take money out of the customer trust and give it back to the customer.

Implication 2: This can be done with banks also

Bank accounts can be broken up into two kinds: illiquid and liquid. (From a customer perspective, this is analogous to the Tier 1 and Tier 2 of the New Pension System; the former is illiquid and the latter is demandable). Illiquid accounts would be loans from customers to the bank (as all bank deposits today are) and have greater restrictions against convertibility. Liquid accounts would not belong to the bank. They would be segregated client funds, used for payments activities.

This would derisk customers from the problems associated with bank failure. It would greatly reduce the complexities of banking regulation and supervision. It would put banks on a level playing field when compared with other technological strategies in the field of payments.

When banks do not capture the interest income on the liquid accounts, this will force a healthy unbundling of payments and banking. Banks who engage in the payments business would have to explicitly charge for payments services. This would help ensure a level playing field between bank and non-bank players in payments.

Implication 3: How to store segregated client funds

Payment vendors could place client funds into current accounts with the central bank for riskless safekeeping. Or, they could place them into NAV-based money market mutual funds, so as to earn some return.

In this framework, there would be N money market mutual fund accounts belonging to M entities. The payments system would be a technologically diverse array of alternative competing mechanisms through which money flows from account i to account j, which generates a fee income for the payments provider.

Conclusion

The idea of segregated client funds, which is very well established in some areas of finance such as money management, brokerage, etc., can be usefully applied in the field of payments, to cut through the gordian knot of banks and payments.

Saturday, June 16, 2012

Trading in the rupee: Starting to look like serious numbers

The rupee-dollar is the most important price of the Indian economy. It is discovered on the currency market. What are the contours of this market? Specifically:

- How big is the daily trading in the rupee?

- Where does the rupee stand, in global rankings of currencies?

- Where does trading take place?

- Where are we on the onshore versus offshore distinction?

How big is the daily trading in the rupee?

Trading in the rupee is composed of the following elements of the market:

| Exchange-traded | OTC | |

| Onshore | Options, futures | Spot, forwards, swaps, options |

| Offshore | Futures | Forwards, swaps, options |

We attempt an estimate of turnover across all components, on 25 May 2012:[1]

| Location | Billion USD |

|---|---|

| OTC Spot (onshore) | 19.82 |

| OTC Forwards (onshore) | 4.40 |

| OTC Swaps (onshore) | 11.34 |

| Exchange Futures (onshore) | 7.02 |

| Exchange Options (onshore) | 1.45 |

| Exchange Futures (offshore) | 1.17 [a] |

| OTC (offshore) | 20.03 [b] |

| Total | 65.23 |

| Source:- RBI Weekly Statistical Supplement, NSE, USE, MCX-SX, DGCX, and BIS Survey (Tables D.1.1 and D.1.2) | |

| [a] DGCX data as on June 6, 2012 for May 2012. | |

| [b] This is the April 2010 BIS survey valuation of the offshore market, adjusted for the DGCX daily average value (estimated from overall value of futures contracts) for April 2010. | |

This is an under estimate for two reasons. Data for one important element (offshore OTC) pertains to April 2010; the market must have grown since then. Data from the BIS is likely to not capture activities of non-bank players.

Three interesting facts come out of this. First, that the overall market for the rupee is roughly $70 billion a day. Second, that roughly one-third of it is spot, and the rest is derivatives. Third, that rougly one-third of it is offshore.

Growth in recent years has been tremendous. In May 2000, the onshore market did only $2.7 billion a day. That is, we've got 24x growth over 12 years.

Where does the rupee stand, in global rankings of currencies?

BIS surveys global banks and reveals interesting data about the currency market. However, it is likely that the BIS misses out on a great deal of non-bank activity. If a hedge fund sends an order to an exchange, this is likely to elude the measurement of the BIS.

According to the BIS, in April 2010, the daily average turnover for the INR against the USD was a total of U$41.7 billion. [2] INR then ranked 15th (spot), 10th (forwards) and 22nd (swaps) in a pool of 28 currencies covered in this BIS survey. Summing up, the rupee stood at rank 16 in their group of 28 currencies. In the class of emerging markets, the rupee ranked fourth, third and ninth in the spot, forwards and swap markets respectively:

Ranking among EMs |

|||

| Currency | Spot | Forwards | Swaps |

|---|---|---|---|

| Korean Won | 1 | 1 | 3 |

| Mexican Peso | 2 | 6 | 1 |

| Russian Ruble | 3 | 12 | 5 |

| Indian Rupee | 4 | 3 | 9 |

| South African Rand | 5 | 9 | 4 |

| Brazilan Real | 6 | 4 | 14 |

| Chinese Renminbi | 7 | 2 | 8 |

| Turkish Lira | 8 | 8 | 6 |

| Polish Zloty | 9 | 7 | 2 |

| Taiwan Dollar | 10 | 5 | 11 |

Source:- BIS Survey, Tables D.1.1 and D.1.2 | |||

The BIS triennial survey included the INR since 1998. The three-yearly snapshot of Rupee's position marks its rise over time. Measuring only the spot market, the rupee ranked 13 (tied with Hungary, Indonesia and Chile) in 1998 and moved to the third position in 2010. In terms of change, the rupee has moved dramatically, perhaps, with no other currency witnessing such rapid change.

Emerging market currencies rank: spot market |

|||||

| Economy | 1998 | 2001 | 2004 | 2007 | 2010 |

|---|---|---|---|---|---|

| Russia | 2 | 1 | 1 | 1 | 1 |

| Korea | 6 | 2 | 3 | 2 | 2 |

| India | 13 | 10 | 6 | 3 | 3 |

| Brazil | 3 | 4 | 6 | 7 | 5 |

| China | 16 | 18 | 17 | 5 | 5 |

| Chinese Taipei | 6 | 6 | 4 | 4 | 6 |

| Mexico | 2 | 4 | 2 | 7 | 8 |

| Turkey | 18 | 17 | 17 | 18 | 8 |

| Malaysia | 16 | 17 | 17 | 13 | 10 |

| South Africa | 4 | 10 | 9 | 8 | 10 |

Source:- BIS Survey, Table D.19 | |||||

The most surprising feature of these results is the extent to which the rupee is a bigger market than the CNY, even though Chinese GDP and internationalisation exceed that of India. It seems to suggest that you'd have to do bigger trades to obtain a 1% change in the INR/USD rate, when compared with the trade size required to obtain the same change with the CNY/USD rate. This helps us see why India has moved into greater exchange rate flexibility when compared with China: there was really no choice.

Where does trading take place?

For the first time, Table D.6 of the triennial survey provides information about where currency trading takes place. A surprisingly diverse set of locations light up:

Location of the currency market (% of turnover) |

|||||

| Location | BRL | CNY | INR | KRW | ZAR |

|---|---|---|---|---|---|

| India | -- | -- | 50.02 | 0.00 | 0.04 |

| Australia | 0.51 | 0.44 | 0.31 | 0.50 | 1.20 |

| Brazil | 29.68 | 0.01 | 0.00 | 0.01 | 0.07 |

| Canada | 4.66 | 1.36 | 0.15 | 0.18 | 0.39 |

| China | -- | 24.87 | -- | 0.00 | 0.06 |

| Hong Kong SAR | -- | 27.29 | 10.91 | 10.33 | -- |

| Japan | 0.05 | 0.28 | 0.21 | 0.19 | 4.65 |

| Korea | 0.05 | 0.03 | 0.02 | 52.13 | 0.02 |

| Singapore | 1.07 | 19.01 | 16.12 | 21.01 | 1.18 |

| United Kingdom | 19.18 | 17.29 | 12.32 | 10.98 | 36.43 |

| United States | 37.53 | 7.72 | 9.26 | 3.95 | 8.36 |

Source:- BIS Survey, Table D.6 |

|||||

Where are we on the onshore versus offshore distinction?

As the table above suggests, roughly half of rupee trading takes place in India. The issues which shape this onshore versus offshore market share are likely to be similar to those seen with Nifty. Recent events are likely to have driven the share of the onshore market to below 50%.

The onshore OTC market consists of forex spot transactions, forwards and swaps. The RBI publishes information on turnover in the onshore spot and forward market and the forward and spot legs of the swap transaction are captured in this data as well. An RBI report on OTC derivatives in 2011 highlights that OTC derivative turnover was 3.53 trillion USD in FY2009-10. Out of this, forex swaps account for over 60% of the total turnover in the same period. Here is the time series for the onshore OTC market:

| Source: RBI, Weekly Statistical Supplement (1996 - 2012) |

Exchange-trading of the rupee, in India, started in 2010. At a point in time, turnover in exchange-traded currency futures did seem to have overtaken the OTC forward market. The USD-INR futures contract on MCX-SX, NSE, and USE with a contract size of USD 1000 occupied the first three ranks for volume in the world in 2010 and 2011. The USD-INR options contract on the NSE ranked fourth while the EUR-INR futures on the NSE also featured in the top 20 forex futures contracts in the world. The collapse in the following graph, which shows exchange traded onshore turnover, is associated with the CCI order:

| Source: NSE, MCX-SX, and USE |

Putting together the information from the onshore exchange-traded market (options, and futures) and the onshore OTC market (spot, forward, swaps data from the RBI), one gets a complete picture about the onshore INR market:

| Source: RBI, NSE, MCX-SX, and USE |

The most recent BIS triennial survey (April 2010) had placed the onshore market (USD-INR) at about U$20 billion. As the graph above shows, current values are more like U$30 billion a day. The offshore market is likely to have grown more, giving total INR turnover of well above U$70 billion a day. This puts the Indian rupee today above the Korean Won as of April 2010.

Conclusions

The Indian rupee has grown rapidly to becoming the sixteenth most traded currency in the world. From less than 0.2% of the world forex turnover in 1998, it has grown rapidly to constitute about 0.9% of the world forex turnover in April 2010. It is one of the biggest emerging market currencies with the Korean Won, Russian Ruble, Chinese Renminbi and the Mexican Peso being its close competitors. The offshore market today is as big as the onshore market, as is seen by other EMs. Today, the rupee does roughly $70 billion a day, roughly where the biggest EM currency (the KRW) was in 2010.

These developments have many ramifications:

- The rise of a large currency market is consistent with India's rapid integration into the world economy of recent decades.

- When a market does turnover of $70 billion a day, market manipulation is difficult. Manipulating the rupee is now as hard as manipulating Nifty: both are large globally traded products with highly liquid markets. This is the essence of India's evolution away from an INR/USD pegged exchange rate to a mostly-floating exchange rate: the monetary policy distortions required to support manipulation became too large.

- As with Nifty, mistakes of domestic policy are giving a substantial shift in India-related finance to overseas locations. The two most important pillars of the Indian financial system are trading in the rupee and in the Nifty, and with both these, India is rapidly losing ground. If present policy mistakes continue, the role of the onshore market will continue to decline, for both the rupee and Nifty.

- In the last 12 years, there was 24x growth. Suppose there is only 10x growth in the next 10 years. That would take us to $700 billion a day, which would be quite something.

- Looking into the future, if India is able to continue on the course of high GDP growth and integration into the world economy, the rupee will become a big currency by world standards. The big four currencies today are the USD, EUR, JPY, GBP. It is not inconceivable to think of CNY and INR joining that club. This could connect nicely with a role for India in global finance. But for all these good things to happen, we have to put our house in order.

Notes

| [1] Forward market turnover is estimated as purchase + sale - cancellation. |

| [2] The BIS survey also does cross-border netting - something that we cannot adjust for from the RBI data. However, as Jayanth Varma points out, this may not be a very large number that the overall calculations dramatically change. |

Thursday, June 14, 2012

Interesting readings

Jeff Glekin on Reuters Breakingviews about who could succeed Pranab Mukherjee as FM, and Kaveree Bamzai in the India Today about what could come next if he leaves. Who will be the President? This time, it matters by Satarupa Bhattacharjya of Reuters in Mint.

The delicate technology of creating excellence by Pradip Ghosh in the Telegraph. Also see.

Garima Jain in Tehelka magazine about guns in Punjab. It's remarkable how much our side of the Punjab is like, when compared with the other side.

The Wanderer's Eye is a remarkable blog being written out of India by Aniruddha H. D..

On the problem of the hollowing out of the Indian financial system, read Shaji Vikraman and Ram Sahgal in the Economic Times.

Ravi Jagannathan on Firstpost, on the Sahara vs. SEBI case at the Supreme Court.

Dhiraj Nayyar in India Today on the woes of the Indian oligarchs.

Sajjid Chinoy in the Business Standard on what is going wrong with investment.

A. K. Bhattacharya in the Business Standard on how tax authorities in India have gone astray.

Dinesh Unnikrishnan in Mint about the unique problems of public sector banks.

Sean O'Hagan, writing the Guardian about Robert Capa and Gerda Taro, reminds us that we're stuck in a pastel coloured world.

Paul Krugman has a nice old article on comprehending comparative advantage: Ricardo's difficult idea. He ends with advice which could well be applied to all economic policy debates in India: (i) Take ignorance seriously; they actually do not know. (ii) Adopt the stance of rebel. (iii) Don't take simple things for granted. (iv) Justify modeling.

Jon Lackman in Wired magazine, on what is uber-cool in Paris today.

Wednesday, June 13, 2012

Opportunities in the Macro/Finance Group at NIPFP

The Macro/Finance Group at NIPFP offers opportunities for interesting and important policy work which is connected with the ground realities of India's economic reform. One of the important projects being undertaken, at present, is research support for the Financial Sector Legislative Reforms Commission.

Policy work is highly inter-disciplinary. The policy group at NIPFP is particularly looking for people with a knowledge of financial regulation and law. Deep practitioner knowledge, about the ground realities of law and regulation are important. Equally important is the instinct of looking beyond the present and envisioning the future, drawing on strong foundations of public economics and international experience. We welcome interest in these positions by people with strong capabilities in at least one of these areas, and curiosity about the other. The ideal candidates would have read the Percy Mistry and Raghuram Rajan reports, and have familiarity with the things being talked about in this blog.

The Macro/Finance Group at NIPFP is a conducive research environment including a modern office. Compensation is generally superior to that seen in government academic institutions. There is joint work and spillovers of knowledge with the quantitative research team within the Macro/Finance Group.

If this interests you, please contact Anurodh Sharma (anurodh54 at gmail.com) with your resume by 22 June 2012, where you clearly identify where your interests and capabilities lie.

Saturday, June 09, 2012

Is building and running the IIT JEE a public goods problem?

What should government do?

In the question "What should government do?", economists have one big answer "do the public goods". A public good is something that is non-rival (the consumption by one does not come at the cost of consumption by another) and non-excludable (it is not possible to exclude someone from benefiting from the public good).

The regulation of air pollution is the favourite example which illustrates a public good. Clean air is non-rival (if you breathe clean air, it does not diminish my supply of clean air) and non-excludable (if the air is cleaned up, nobody can prevent me from breathing it in). Indeed, nothing that one person can do can make a difference to air pollution. Only the government can regulate pollution and this deliver clean air.

Similar issues arise with defence, police, judiciary, monetary policy, financial regulation, public health (though not the health of the public), biodiversity, etc., all of which add up to the economists' vision of what government should be doing.

What should government do in the field of education?

Education is substantially a private good. I study, I benefit. There are spillovers ("externalities") to others, and so there is a case for a government subsidy. But barring that, this is a field where the incentives are well aligned for each person to be the main one in charge of his own education.

Public funding solves the problem of externalities. At the level of elementary education, vouchers are a nice way to deliver public funding that is large enough to pay for the externalities. At the level of higher education, public policy can focus on economies of agglomeration alongside some public funding, nudging the outcome in India so that there are 100 high quality broad-based universities.

As I read The delicate technology of creating excellence by Pradip Ghosh in the Telegraph, I was reminded of the public goods character of testing and curriculum development. As he says:

The production of education services is a private good problem, to be sorted out between one student and one education provider. However, the problems of curriculum and testing have a public goods character. Let's run the tests of a public good, for a nationwide system for standardisation of curriculum and testing.in this very large country with a multitude of school boards and their non-uniform curricula and examination standards, it would be inappropriate to go by board grades because that would yield unreliable, undesirable results — we would not get the best students. And, such a course, therefore, would be unfair both to the aspiring students and to the institutions they would be entering. A single post-high school examination with a well-defined syllabus and a centrally administered paper-setting and grading system was thought to be the best alternative

Is it non-rival? Does the consumption of the services of this system by one person diminish the amount of this system available for another? With computerised testing, there should be full scalability (though Pradip Ghosh argues, in the article above, that there are problems with this).

Is it non-excludable? High quality curriculum is non-excludable in that once curriculum documents are on a website, everyone can download them. Testing is excludable if you want to be cussed about it, but for the rest it should not be possible to exclude anyone from taking a nationwide test.

This argument guides us in thinking about what government should be doing in the field of education:

- Funding (calibrated to overcome the externalities)

- Curriculum development

- Testing

- Information infrastructure about education service providers (i.e. schools but also all sorts of new ways of organising education service delivery) so as to assist choice by parents and students.

Central government or local government?

Once we know that testing and curriculum are public goods, we have to ask who should do it.

If an important outcome (getting into the IITs) was linked to regional board examinations, that is a recipe for grade inflation. This is a reason for doing this at the central government.

There are economies of scale. A curriculum only needs to be developed once. This is a reason for doing this at the central government.

Monday, June 04, 2012

Uptake of systems like Amazon's `Mechanical Turk' in India

In a recent issue of The Economist, I was surprised to discover (a) that Amazon's Mechanical Turk has 0.5 million workers and (b) that roughly a third are from India. That's roughly 150,000 persons in India who are plugged into Amazon's Mechanical Turk. We don't know how many hours/week are spent in doing labour supply, but it's still a lot.

There are a few other such systems also. Here are links for exploration: oDesk, CrowdFlower, Elance, Amazon's Mechanical Turk.

These mechanisms add up to a whole new world for the functioning of the labour market. For first world customers who would like to connect up to cheap labour in India, our traditional view was that there had to be a man in the middle - a Datamatics or a TCS or an IBM. What these new systems seem to suggest is that for a certain class of tasks, it is possible to disintermediate the Datamatics or TCS or IBM.

For many individuals in India, the flexibility of working from home without rigidity about how many hours are supplied, and when, these systems could be a big win. At present, many households do not have computers and broadband connections, which is an important impediment. But this is also a constraint that is being rapidly eased through 3G, LTE, etc. These developments, put together, could become a whole new chapter in the story of India's connecting up to globalisation.